Discover more about S&P Global’s offerings

Relations between states and the central government will determine whether India’s national strength equals the sum of its parts.

Published: August 3, 2023

India’s realized — and unrealized — potential over the next decade will be a story about the successes and opportunities of its diverse states.

Center-state relations will increasingly be characterized by “competitive federalism,” with central and state governments jostling for investment and employment opportunities.

A key question for India will be how the center and states devolve more power and responsibilities to increasingly important city governments, which need to create timely and effective solutions to multigenerational challenges.

An oft-cited truism is that India is characterized more than anything by its diversity. This is clearly illustrated by its 28 states and eight union territories. Such a range of subnational entities presents benefits and challenges as India aims for greater social and economic dynamism domestically, and for elevated influence internationally.

India’s potential growth over the next decade will be shaped by its diverse states and their alignment with the constitutionally mandated strong central government.

India’s political and economic integrity has historically been based on “cooperative federalism,” an approach that espouses mutually beneficial coordination between the center and state governments in solving problems and unlocking capabilities. Center-state relations in the coming years are more likely to be characterized by “competitive federalism,” where central and state governments jostle for investment opportunities and the chance to create jobs. These tensions are heightened when some states benefit from close ties with the central government or from inherent advantages such as size, geography or population.

More competitive elections in India are also driving competitive federalism, particularly because voters increasingly distinguish between state and parliamentary polls. This trend encourages national and subnational governments to pursue policies that go beyond their traditional mandates. The constitution broadly gives strategic authority to the central government and functional authority to the states.

While competitive federalism will dominate, prospects for cooperative federalism still exist and will be pursued intermittently. International governments and businesses engaging with India will need political astuteness to navigate different layers of bureaucracy and stakeholder interests.

International governments and businesses engaging with India will need political astuteness to navigate different layers of bureaucracy and stakeholder interests.

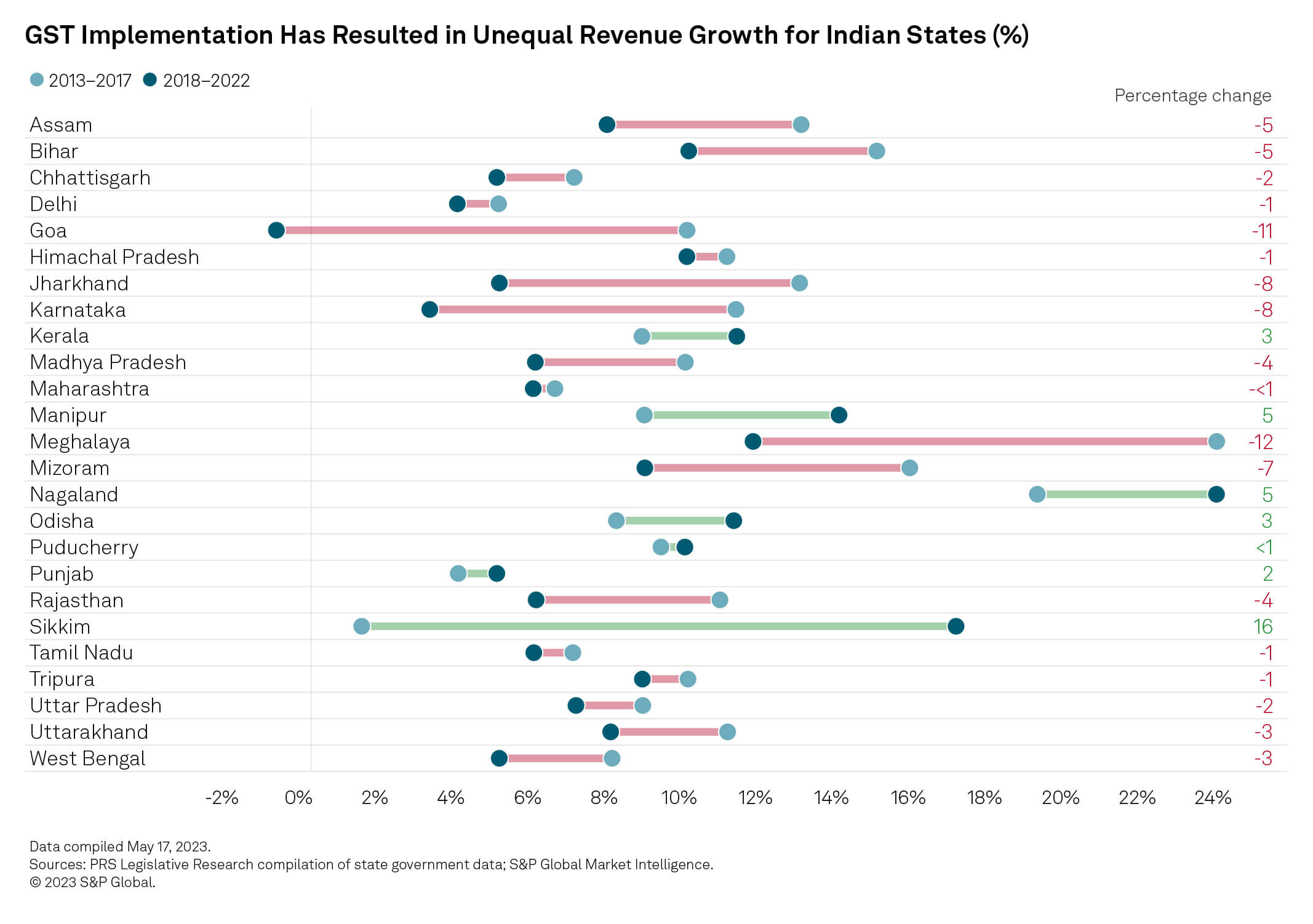

An example of cooperative federalism in India is the 2017 adoption of the Goods and Services Tax (GST), which marked a massive center-state alignment. GST was introduced with the goal of boosting integration in the Indian economy and of potentially spurring foreign investment. States transferred significant tax collection powers to the center under GST in return for economic efficiencies.

Placing the central government at the heart of GST incentivizes it to focus on the advantages of the system rather than its drawbacks. The potential gains include simpler taxes for small businesses, easier interstate trade and improved government revenue collection. The biggest impediment for the central government is working out how to divide tax revenue between the various states.

Calls from both more and less developed states to change how GST funds are redistributed — along with the central government’s response — will test the system’s spirit of cooperative federalism. States’ increasing responsibility for policy execution, including politically sensitive social welfare schemes, will further intensify this argument.

The GST Council, which includes representation from all states and the center, will help in maximizing GST’s benefits and in addressing states’ concerns. It can also serve as a template for center-state coordination in other areas.

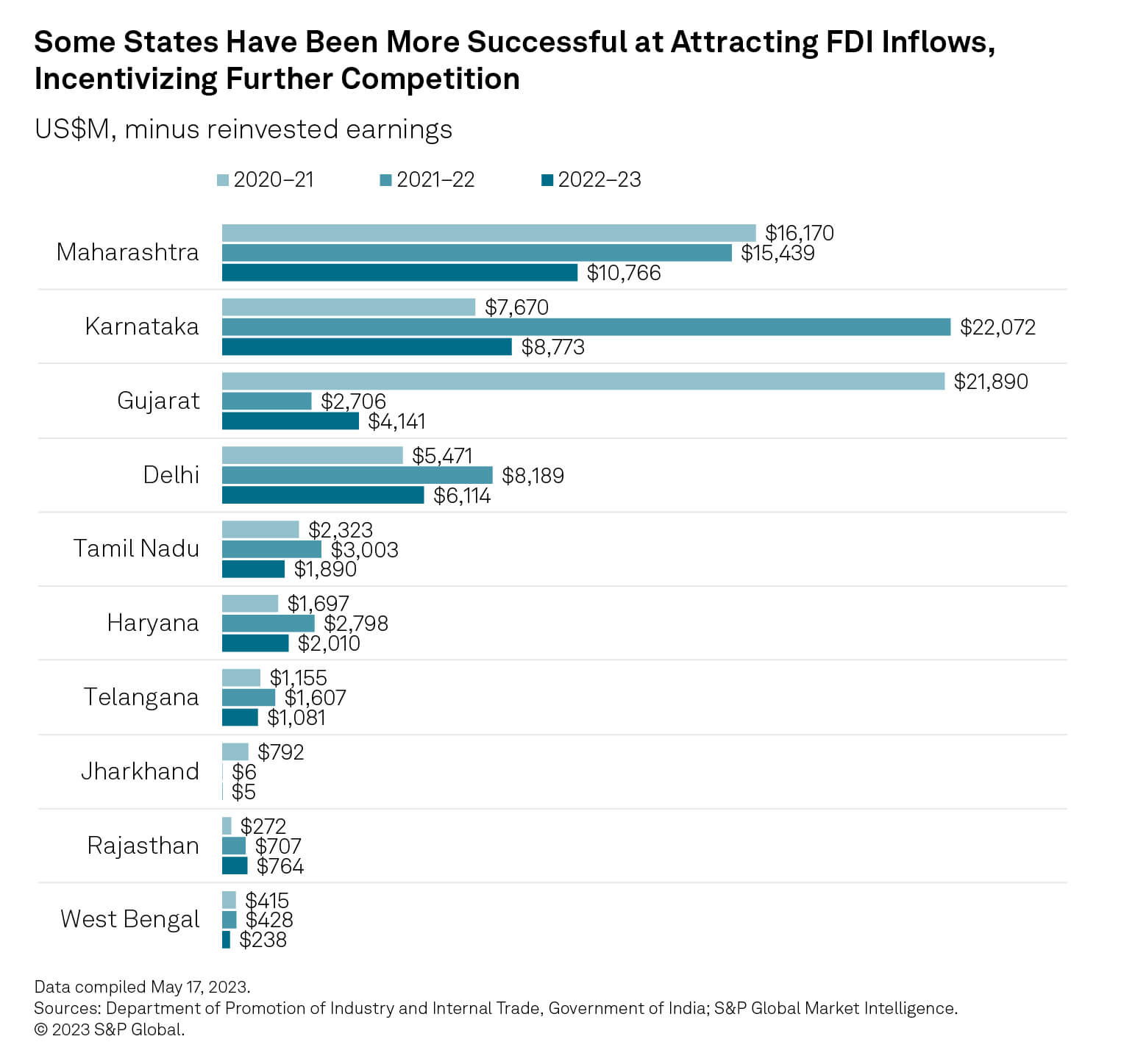

Indian states’ unique pathways to growth will influence their future reforms and development. Competition among states will also only increase as the country’s huge and expanding population of workers and consumers fuels investor interest in the country.

Indian states will likely adopt differing policies for land acquisitions, tax incentives and especially labor reform, reflecting local conditions. They will also want to deliver reforms in ways that give them an advantage over other states in the competition for foreign direct investment.

Tensions between states and the central government are also inherent in the system because of states’ reliance on the central government for revenue. An argument is often presented that relations can ease when the same party runs the state and the central government, but these spells are intermittent owing to subnational election cycles.

The center and states will continue to diverge at times on policy, but the overarching ambition to maximize India’s growth potential and geopolitical influence remains the same. Businesses operating in India must recognize that each state is distinct and that each needs its own curated solution. Still, the country’s reform gradualism lessens policy uncertainty that stems from political upheavals.

Mutual support and coordination across cities, states and the central government will be necessary if India is to fulfill its ambition of becoming a global manufacturing hub as well as realizing its goals in energy transition and agriculture.

Successive central governments will need to find ways of equitably sharing revenue with states. This means adequately compensating states that deliver higher growth while addressing the needs of states that lag. The implementation of GST shows that this can be a point of contention. India’s Finance Commission will be pivotal in tackling this challenge and in setting a precedent.

Another key question is how the center and states will devolve more power and responsibilities to India’s increasingly important city governments. New Delhi, Mumbai, Bengaluru, Chennai and other major cities will be on the front line of multigenerational challenges like climate change and harnessing India’s demographic dividend. Adequately empowering substate governments to be more involved in the last-mile delivery of resources will be crucial for timely and effective responses.

India’s path to becoming a more influential global actor will be determined by how effectively it can manage its federalism balancing act and mobilize the participation of grassroots interests. Mutual support and coordination across cities, states and the central government will be necessary if India is to fulfill its ambition of becoming a global manufacturing hub as well as realizing its goals in energy transition and agriculture. Navigating this dynamic with deliberation and purpose will help India capitalize on the moment it is in now.

India’s global ambitions

Outlook for India’s economic growth and policy platforms

Modi-Biden summit: Key drivers of cooperation

Next Article:

India’s Energy Transition: More Energy, Fewer Emissions

This article was authored by a cross-section of representatives from S&P Global and in certain circumstances external guest authors. The views expressed are those of the authors and do not necessarily reflect the views or positions of any entities they represent and are not necessarily reflected in the products and services those entities offer. This research is a publication of S&P Global and does not comment on current or future credit ratings or credit rating methodologies.