Discover more about S&P Global’s offerings

A strong logistics framework will be key to transforming India from a services-dominated economy into a manufacturing-dominant one.

Published: August 3, 2023

India has an immense opportunity to increase its share of global manufacturing exports, and the government is seeking to raise manufacturing to 25% of GDP from 17.7% by 2025.

Developing a strong logistics framework will be key to transforming India from a services-dominated economy to a manufacturing-dominant one, particularly enhancements in intermodal connectivity and heavy investments in ports and shipping capacity.

Accelerated investments should aid India's ambition; a boom in Indian mobile phone production provides a template for future policies in other sectors.

India stands on the cusp of a massive opportunity to increase its share of global manufacturing exports. Corporate manufacturing giants are looking for alternative production and sourcing destinations to accelerate supply chain diversification. India should benefit from these positive tailwinds, aided by significant milestones already achieved in its domestic and export logistics framework as well as by projects now underway. The telecom sector provides a case study for the delivery of the Modi administration’s “Make in India, Make for the World” policies. Global smartphone manufacturers are setting up shop in India after years of patient government intervention via targeted trade policies focused on phones and components.

Successive Indian governments have emphasized policies promoting domestic manufacturing to reduce India’s import dependence and to increase its share of global exports. The current administration’s focus on “Make in India, Make for the World” encourages investments in manufacturing, especially through Production-Linked Incentive (PLI) schemes. First introduced in 2020 for electronics makers, PLIs provide incentives to domestic and foreign companies that invest in Indian manufacturing and meet predetermined output targets.

India’s policy landscape is often disparate, spanning multiple states with independent reform agendas. Approaching reform at a national level through platforms like PLIs can allow the central government to circumvent state-level differences. Effective uptake of these schemes will be crucial as India seeks to increase manufacturing to 25% of GDP by the year ending March 2025. It was 17.7% last fiscal year, according to S&P Global Market Intelligence.

Policies in complementary sectors — especially logistics — will be key to meeting the government’s goal of transforming India from a services-dominated economy into a manufacturing-dominant one. Sophisticated logistics could give India a competitive advantage over other countries vying for inbound investment.

India’s ability to compete internationally against other manufacturing exporters will be enhanced by its two-pronged approach to logistics. This is focused on improving intermodal connectivity and on heavy investment in ports and shipping capacity.

Capital-intensive infrastructure projects would also be supported by the government’s strong digitalization efforts. Existing frameworks such as the National Logistics Policy (NLP) could help to build a technology-enabled, integrated, cost-effective and dependable logistics ecosystem.

Digital and infrastructure initiatives have already helped India to rise six spots since 2018 in the World Bank’s Logistics Performance Index (LPI), to rank 38th out of 139 countries in 2023. The country has significantly improved its score in four of the six LPI indicators (infrastructure, international shipments, logistics quality and competence, and timeliness), which bodes well for the future.

A key variable affecting India’s manufacturing potential is cost competitiveness in logistics. Costs are about 14% to 18% of GDP, according to the country’s full-year 2022–23 Economic Survey. The government aims to lower these costs to below 10% to be more in line with major Asian exporters.

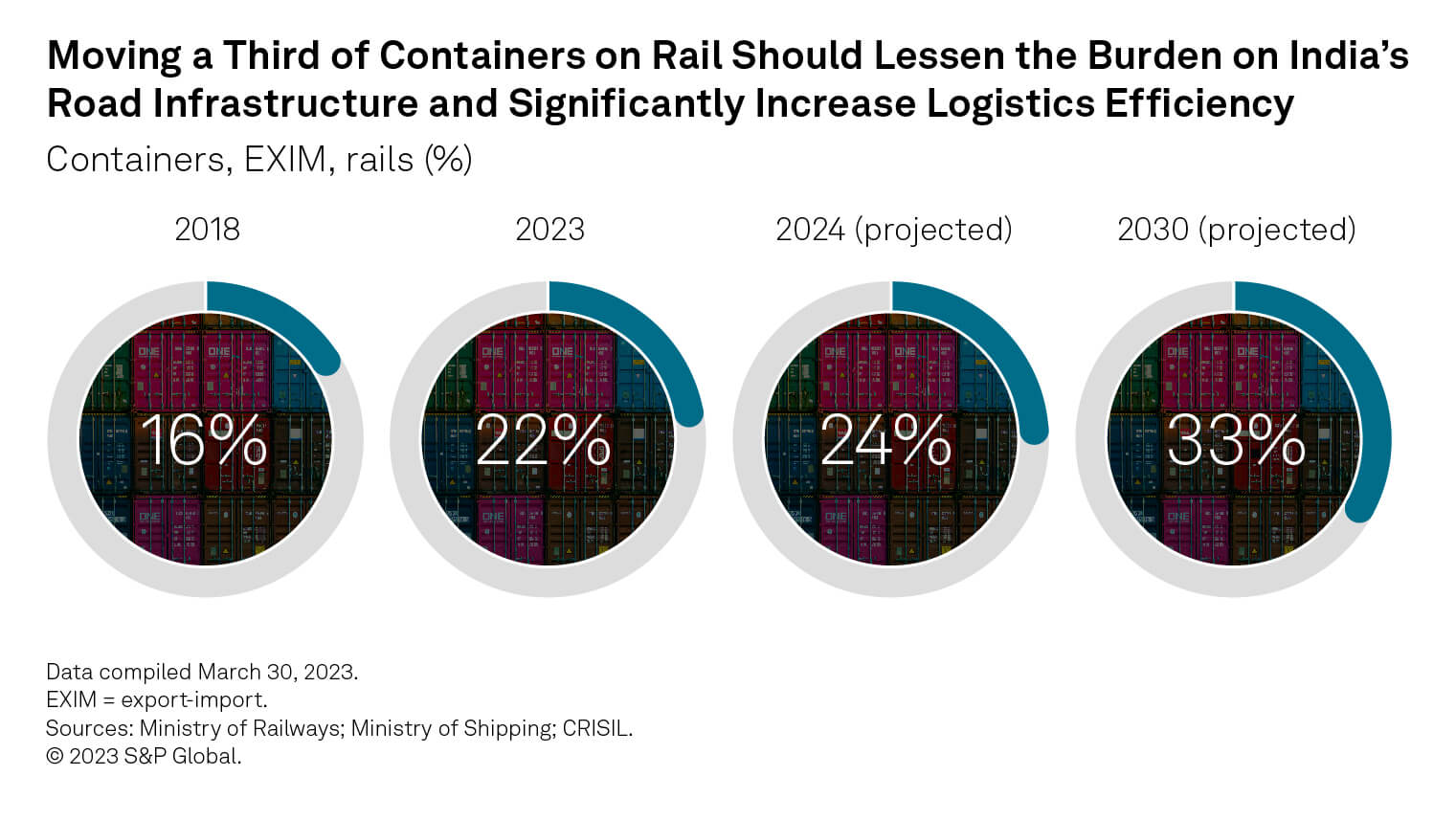

Improving road and rail connectivity will help to cut logistics costs. There is already a noticeable acceleration in national highway building, with the government expecting construction to reach 33 km/day in fiscal year 2024, almost double the 17 km/day achieved in fiscal year 2016. The share of containers being shipped by rail is also rising: It is forecast to hit 23.5% in fiscal year 2024 and 33% in fiscal year 2030, according to the government.

Increasing India’s manufacturing exports in a cost-competitive and efficient manner will require improvements in logistics. The country has geographical advantages including a long coastline of more than 7,500 km and proximity to shipping traffic transiting the Indian Ocean.

Looking Forward

India lags Japan, South Korea and mainland China in export infrastructure and efficiency, particularly in terms of port capacity. To narrow this infrastructure gap and to become the global manufacturing destination of choice, India will need massive upgrades covering areas such as rail, ports and freight corridors.

India needs to reduce its reliance on transshipments via hubs such as Singapore and Hong Kong to help manufacturers avoid potentially lengthy transit times. This means adding efficient high-capacity ports that can handle the largest container ships or incentivizing operators to introduce direct services to major markets. It will also entail strengthening links with global container carriers and freight forwarders.

India has an opportunity to increase its share of global container shipments and bulk commodities, even if North Asia will likely continue to be the driver of global container volumes, according to S&P Global’s Global Trade Analytics suite. Accelerating port infrastructure development will be key to achieving this goal.

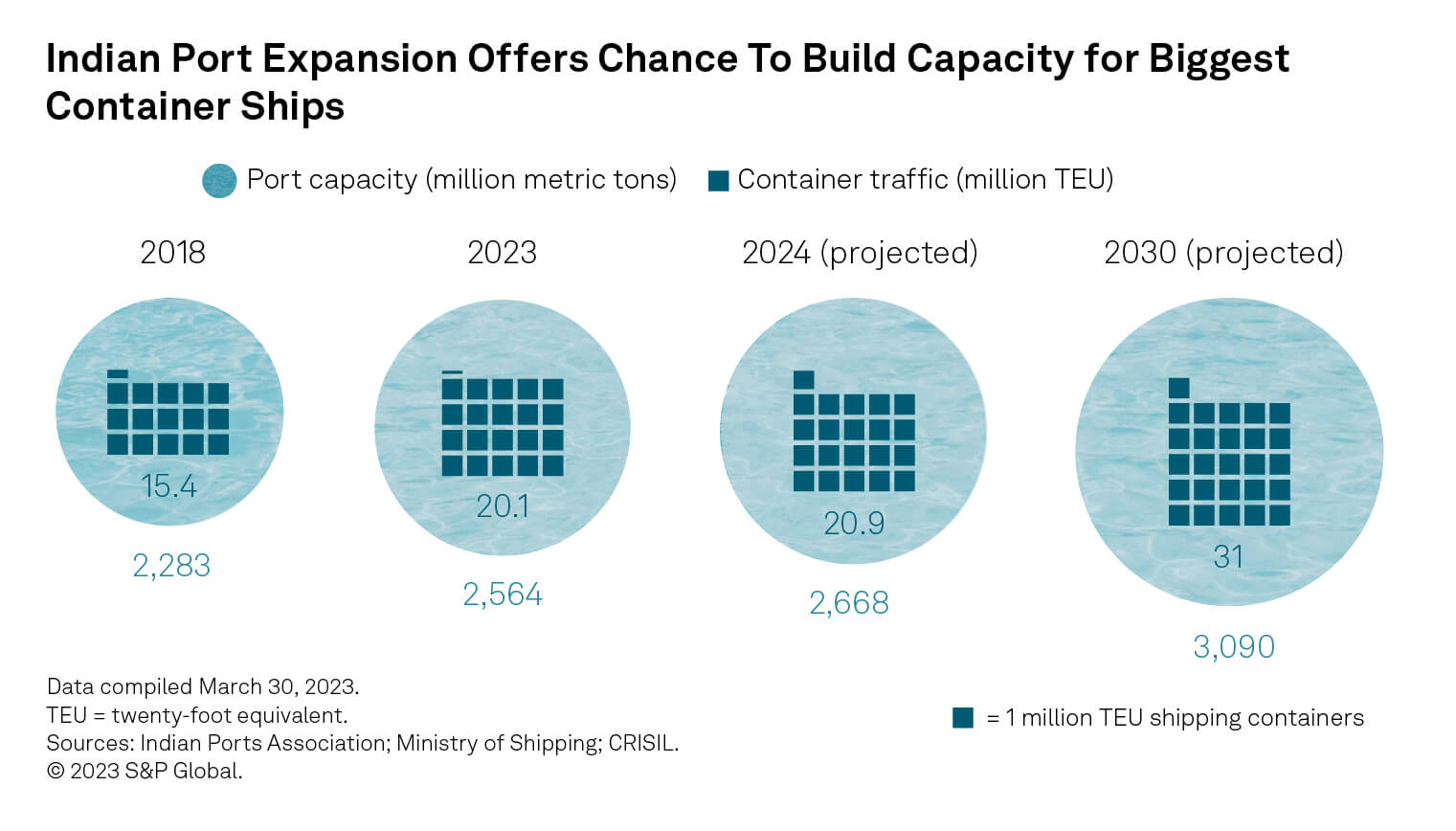

Port capacity and container throughput have experienced robust growth in India over the last five years. Looking forward, capacity will have a compound annual growth rate of 2.7% in 2023–30, with container traffic achieving 6.5%, based on estimates from CRISIL, an S&P Global company. This is growth from a low base, and a key question is how India facilitates significantly more port investments and higher growth rates in support of its bid to become an export powerhouse.

Successfully emerging as a global manufacturing hub is central to achieving India’s domestic growth target and geopolitical ambitions. The path to achieving this goes via the government’s ability to design and build a world-class logistics system, encompassing domestic road and rail networks, as well as international shipping services.

Getting the logistics framework right should facilitate growth in sectors earmarked for exports, especially high-strategic areas like electronics that require tightly integrated supply chains. Electronics makers also generally rely on airfreight, which means the sector is less affected by India’s existing seaport constraints.

India’s policy interventions in the smartphone sector illustrate its ambitions for manufacturing as a conduit to service the domestic market as well as its geopolitical aims. Smartphones are among the most sophisticated manufactured products, and their ubiquity makes them a logical target for any country looking to extend its economic development. The arrival of Apple contractors as major players in Indian mobile phone production shines a light on the nation’s success so far and on its opportunities for future growth.

Reshoring of telecom manufacturing is a competitive field, with India facing significant competition as multinationals look to expand their operations. However, India’s large domestic market gives it an advantage, especially over Southeast Asian countries.

A revolution in India’s telecom services has helped to make the country one of the world’s most digitalized economies. India’s next target is to ensure the availability of low-cost mobile phones.

Sales of telecom products in India are projected to reach $18.3 billion — or 1.3% of the global total — in 2027, according to forecasts by S&P Global Market Intelligence. The market is expected to grow 7.3% annually through 2027, outpacing the global average of 6.2%. India’s large mobile phone sales make it worthwhile setting up local supply chains serving both domestic and export markets. Major manufacturers that already operate in India include Samsung Electronics and Xiaomi, as well as contract producers for Apple including Wistron and Pegatron.

The “Make in India” strategy includes a variety of import restrictions on phones and parts, which offers support to local manufacturers. Domestically produced, low-cost phones may also help bring informal, unregistered businesses into the mainstream economy.

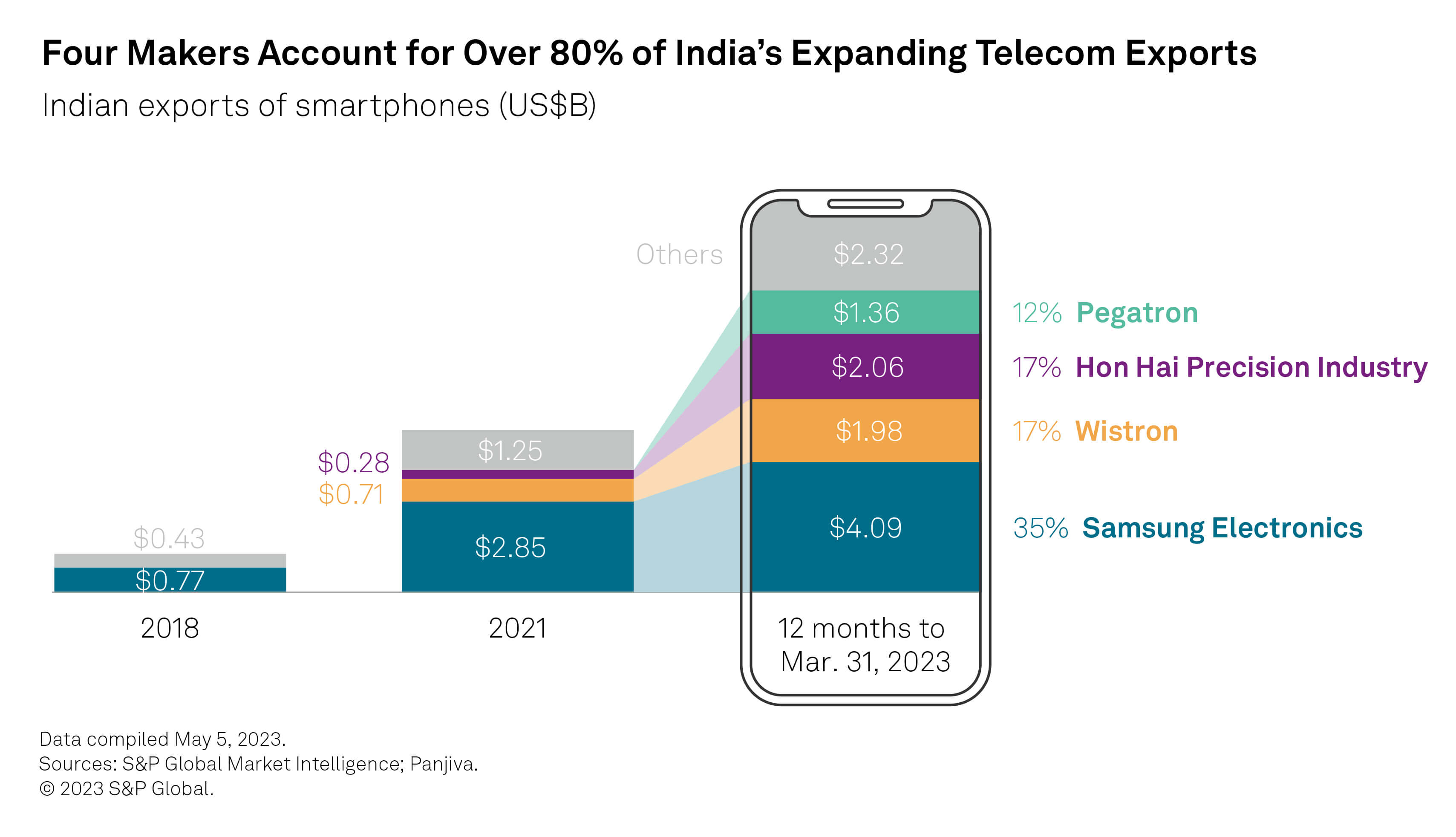

India’s export industry for telecom equipment, including smartphones, is rapidly expanding. Exports reached $11.8 billion in the 12 months to March 31, 2023, data from S&P Global Market Intelligence and Panjiva shows. Samsung Electronics led with 35% of exports, followed by contract manufacturers Wistron and Foxconn (Hon Hai Precision Industry) with 17% each.

To ensure sustainable growth in telecom, public and private sector coordination will be needed to transition beyond only assembling smartphones. This work can always be relocated to lower-cost locations, whereas fully integrated operations are stickier. Such operations would also make India pivotal to the global telecom equipment supply chain.

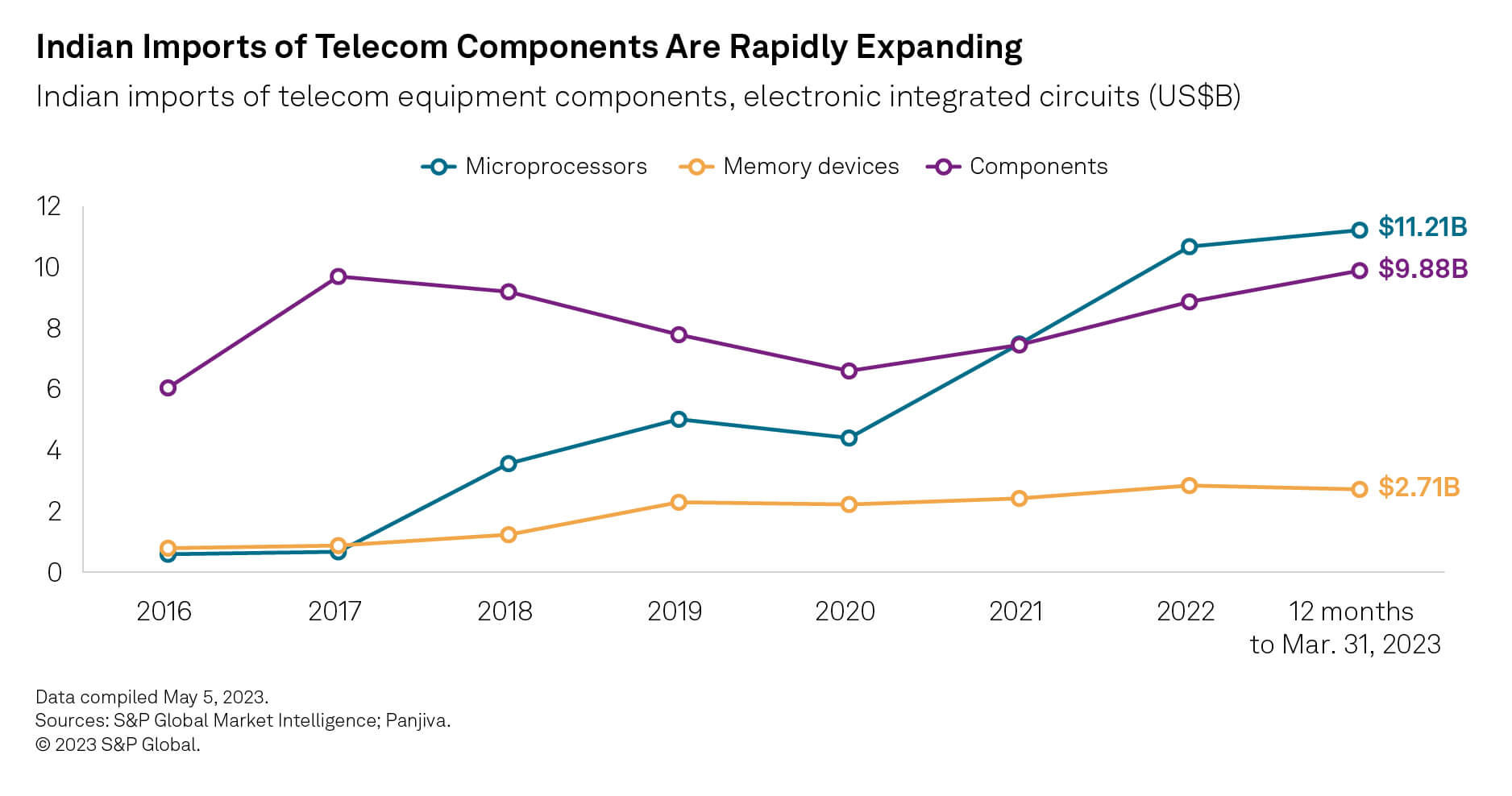

Replicating the full supply chain back to semiconductors is not necessary. For instance, mainland China and Vietnam both import processors and other chips. India’s imports of semiconductors and other parts for telecom and computing devices have tracked steadily upward. Panjiva data shows imports of telecom equipment and computer chips reached $27.4 billion in the 12 months to March 31, 2023, after 12% of compound annual growth since 2017.

India has significant opportunities for manufacturing expansion across a range of sectors. Success so far in smartphone supply chains provides a template for future development potential — in terms of both scale and the complex hurdles to be overcome.

Right place, right time: Supply chain outlook for third quarter 2023

Before the battery and magnet: IRA and mineral supply chains

Next Article:

Future Farming: Agriculture’s Role in a More Sustainable India

This article was authored by a cross-section of representatives from S&P Global and in certain circumstances external guest authors. The views expressed are those of the authors and do not necessarily reflect the views or positions of any entities they represent and are not necessarily reflected in the products and services those entities offer. This research is a publication of S&P Global and does not comment on current or future credit ratings or credit rating methodologies.