Discover more about S&P Global’s offerings

Rising rates and slowing economies mean the world’s high leverage poses a crisis risk.

Published: January 13, 2023

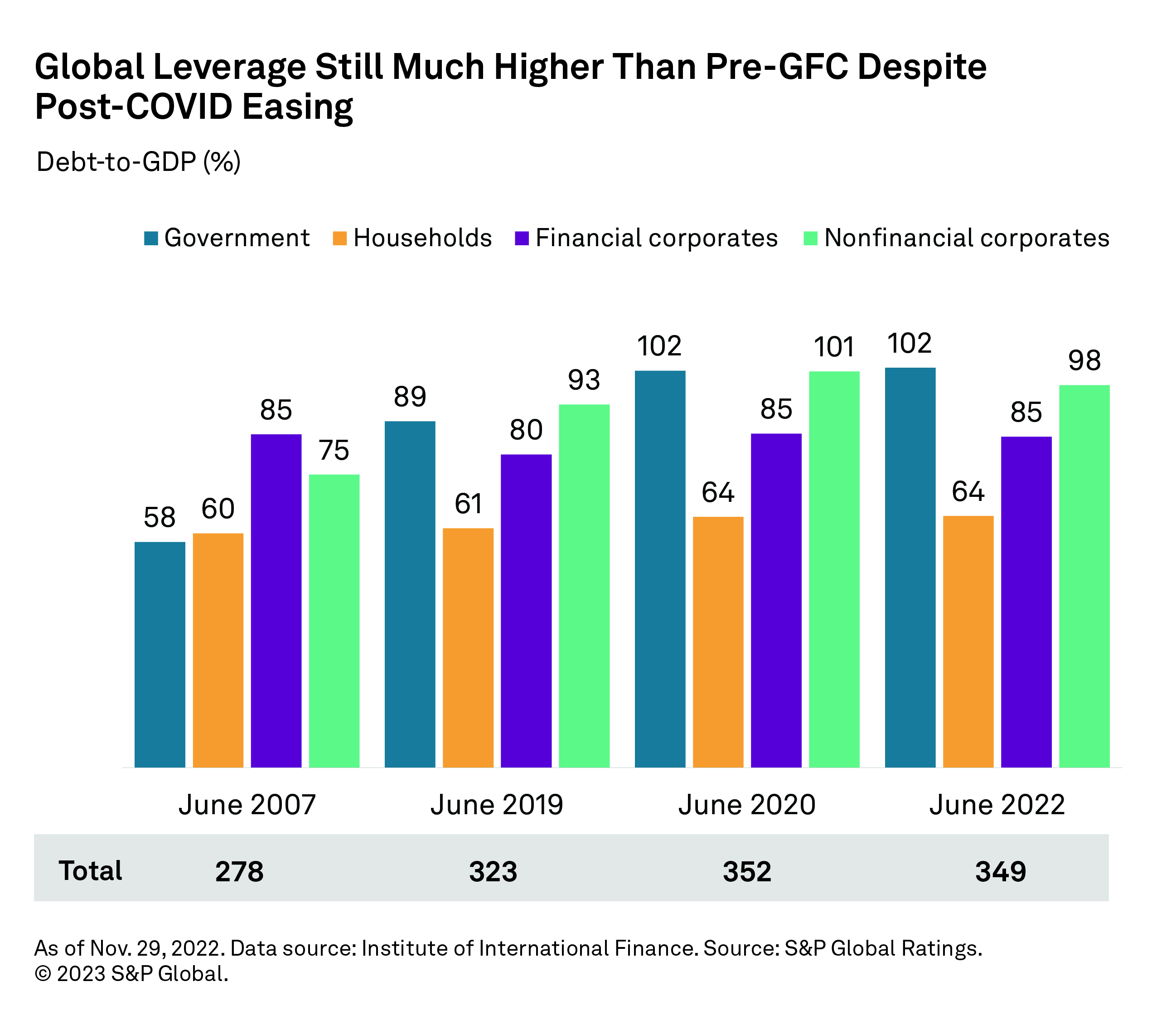

Record leverage. Global debt has hit a record $300 trillion, or 349% leverage on gross domestic product. This translates to $37,500 of average debt for each person in the world versus GDP per capita of just $12,000. Government debt-to-GDP leverage grew aggressively, by 76%, to a total of 102%, from 2007 to 2022.

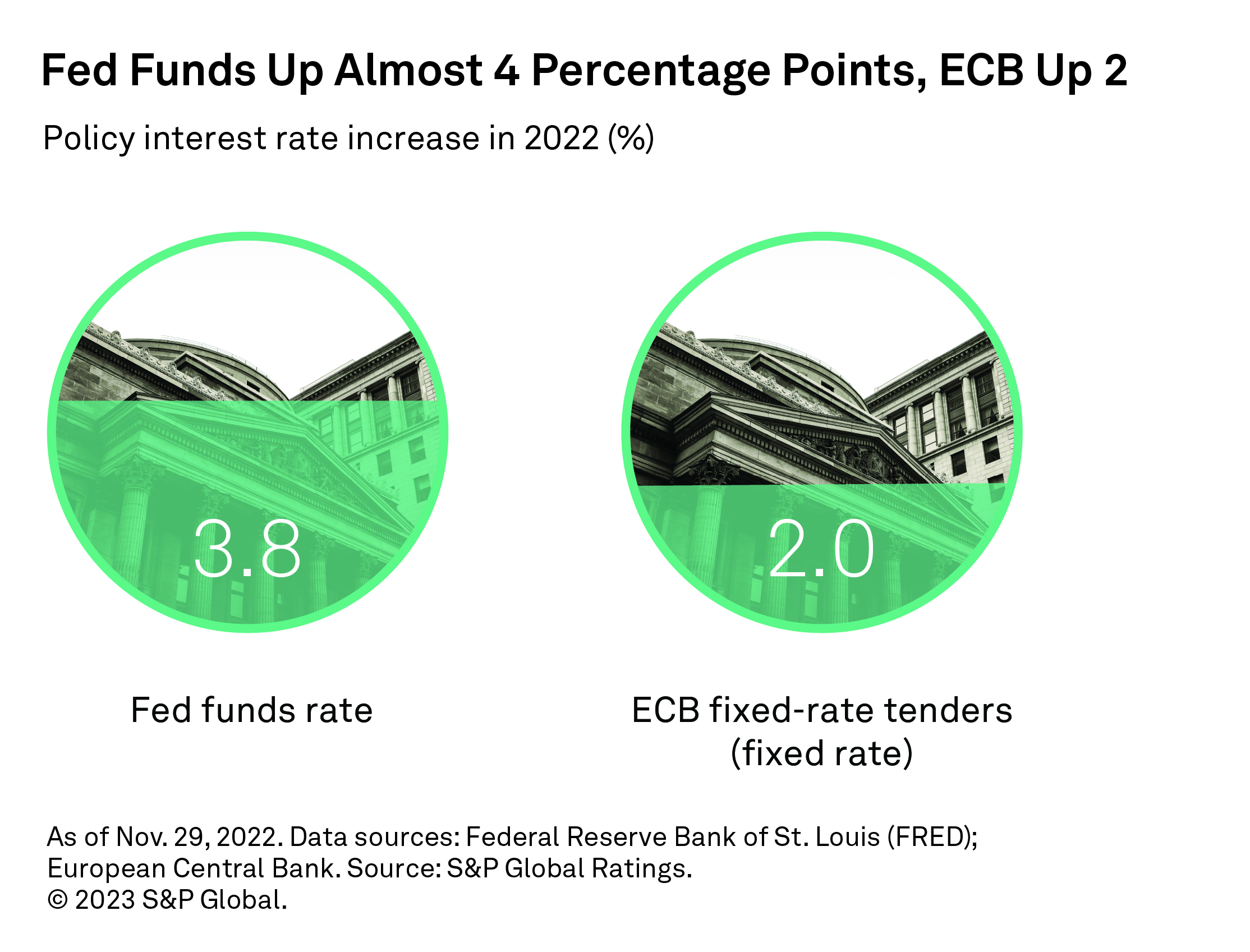

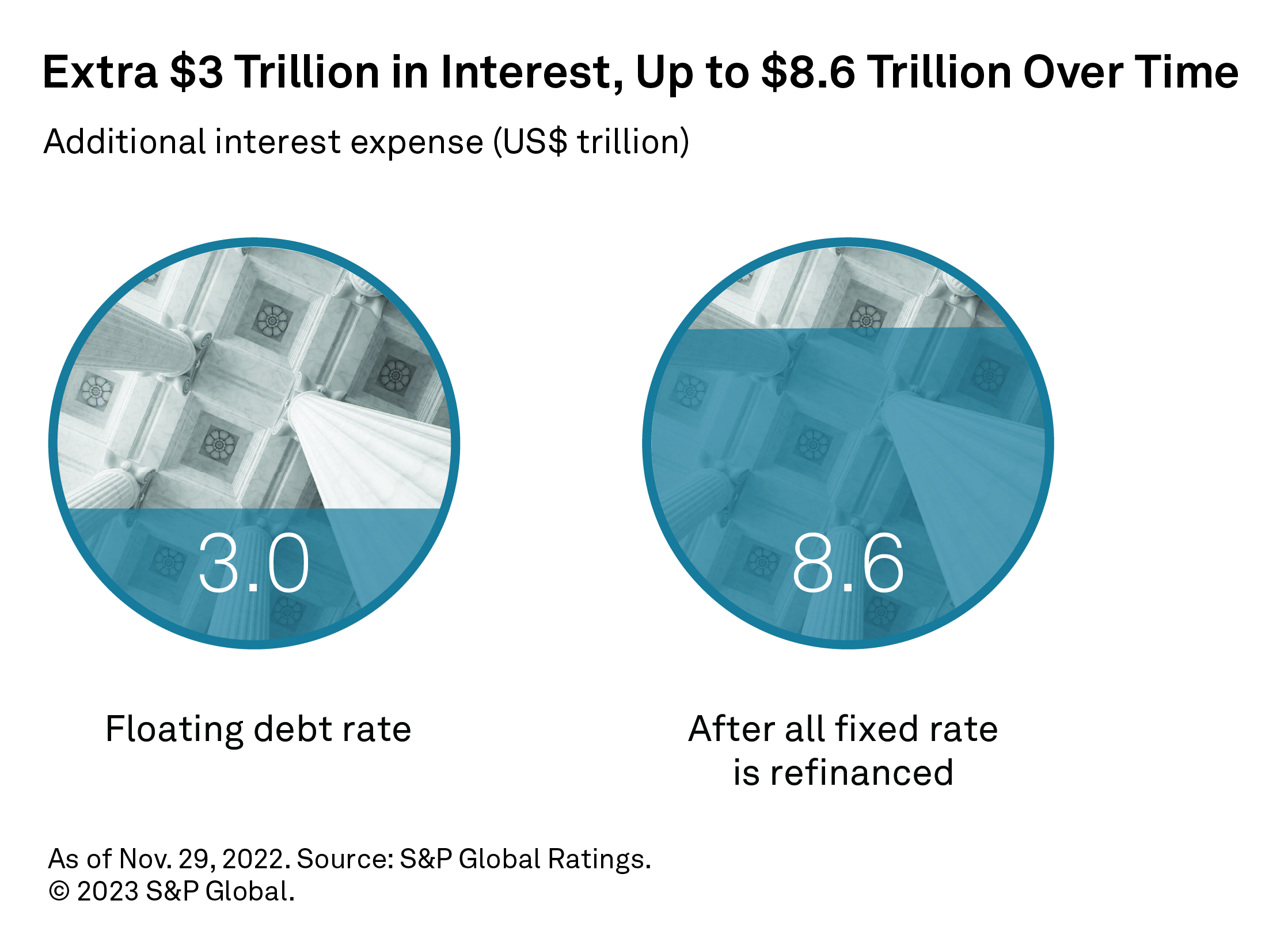

Higher interest rates. Debt servicing has become more difficult. Fed funds and European Central Bank rates were up an average of 3 percentage points in 2022. Assuming 35% of debt is floating rate, this means $3 trillion more in interest expenses, or $380 per capita.

Great Reset. There is no easy way to keep global leverage down. Trade-offs include more cautious lending, reduced overspending, restructuring low-performing enterprises and writing down less-productive debt. This will require a “Great Reset” of policymaker mindset and community acceptance.

The world’s leverage is at a higher level than pre-global financial crisis (GFC) peaks. Yet demand for debt — to help consumers with inflation, mitigate climate change and rebuild infrastructure, for example — will continue. Rising interest rates and slowing economies are making the debt burden heavier. To mitigate the risk of a financial crisis, trade-offs between spending and saving may be needed.

Three hundred trillion dollars. That is the record debt which global governments, households, financial corporates and nonfinancial corporates owed in June 2022, as estimated by the Institute of International Finance. The $300 trillion is equivalent to 349% of global gross domestic product, 26% higher than the pre-GFC figure of 278% (June 2007, see chart 1). The $300 trillion works out to $37,500 of debt for every person in the world, compared to a GDP per capita of just $12,000.

Global governments, households, financial corporates and nonfinancial corporates owe a record $300 trillion as of June 2022.

Chart 1

Productivity from debt has declined. We see this from the upward trend of global debt-to-GDP ratios since the GFC. The economic value-add from every additional dollar of debt has decreased.

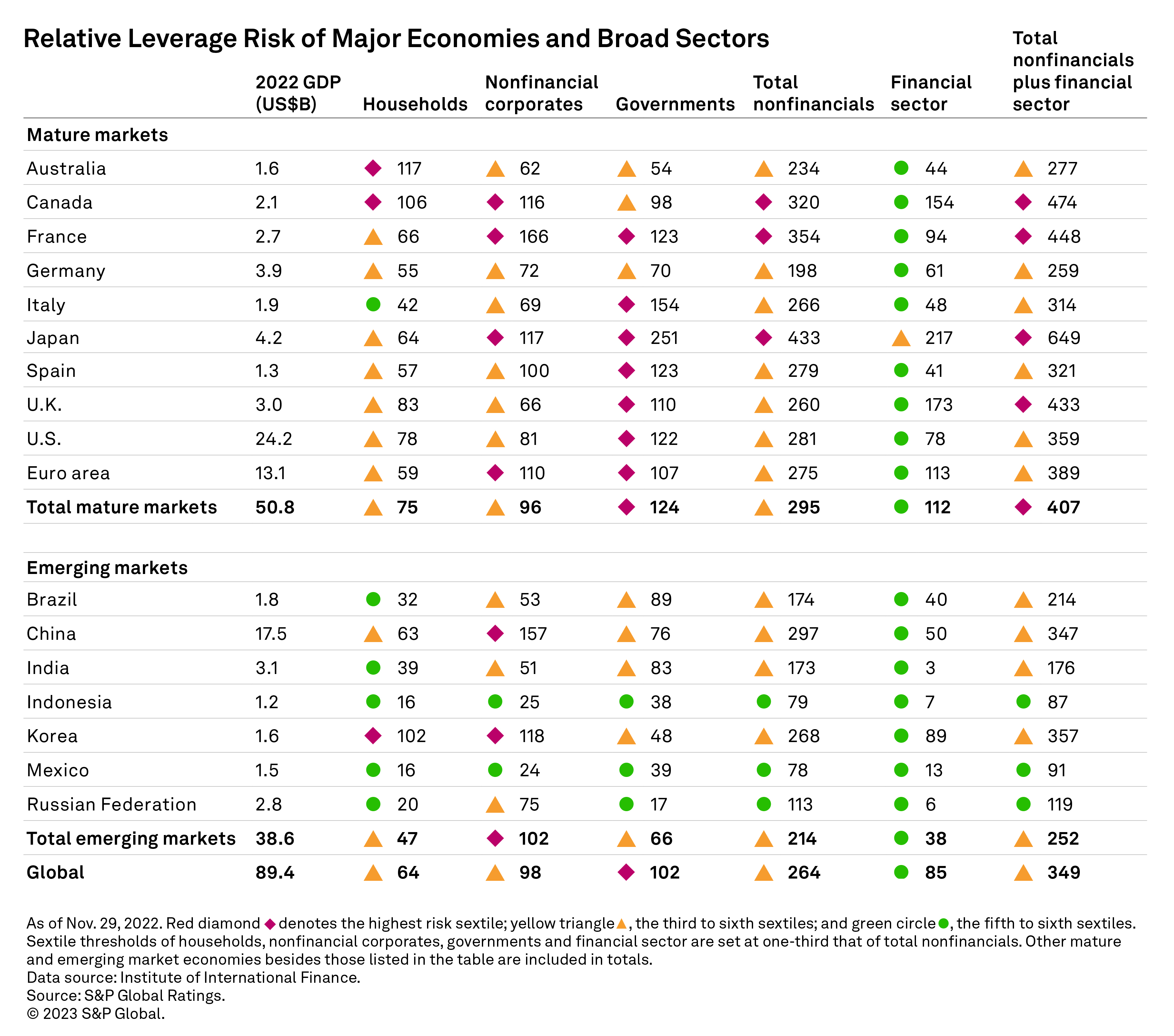

Leverage of the government sector has grown aggressively. The sector’s debt-to-GDP ratio rose 76%, to a total of 102%, from 2007 to 2022. Mature market governments tend to be more leveraged (see table 1).

Nonfinancial corporates’ ratio is up 31%, to 98%. Corporates in some European, Japanese and emerging markets operate at higher leverage levels. China is of particular concern, as its debt makes up a third of global corporate debt. In a sample of more than 6,000 Chinese corporations, the average debt (net of cash) to earnings ratio was 6.0x in 2021, twice the global level. Meanwhile, the percentage of "B-" ratings and below of U.S. speculative-grade issuers doubled, to 36%, in September 2022 compared with September 2007.

Household and financial sectors were more conservative. Household leverage grew just 7%, to 64%. The financial sector was flat, at 85%.

Table 1

Higher returns required. Central banks are raising policy rates, and investors are demanding higher yields, in response to inflation. We see 2022 as the inflexion point of the monetary environment moving away from low interest rates and easy money. Higher yields imply a repricing of assets, while tighter money could translate to lessened market liquidity.

Three trillion more dollars. Higher interest expenses are already straining less-creditworthy governments and corporates, and lower-income households. The fed funds rate went up about 4 percentage points in 2022, and the European Central Bank rate went up 2 (see chart 2). Applying the average of the two rates (3 pps) on the floating-rate portion of debt (we assume 35% of debt is floating and 65% is fixed) implies an additional annual interest expense of $3 trillion (see chart 3). This is equivalent to $380, or 3% of GDP, per capita, on average debt of $37,500. As fixed-rate debt is increasingly refinanced, this amount will rise over time to $8.6 trillion, or $1,080 per capita.

Chart 2

Chart 3

Repricing and project thresholds. Rising interest rates influence asset pricing and project viability. The price of an asset is, in theory, its discounted cash flow. Unsurprisingly, the stock market corrected in 2022. The S&P 500 index price-to-earnings ratio (PE) was 29x at the end of November 2022, implying a 3.5% discount rate (inverse of PE). This rate is about the U.S. "BB" corporate bond average yield in 2021. The PE is now 19x, implying a 5.2% rate — slightly below the "BB" yield for 2022. Previously, borrowers were able to take on low-return projects because of low interest rates. Such projects now require higher return thresholds, making them less viable. This development will add to financial pressures on borrowers and dampen future business activity volumes.

Three scenarios. We examine three possible scenarios to year 2030 of the global debt leverage trend — base case, pessimistic and optimistic.

The projected global debt-to-GDP ratio could reach 366% in 2030, above the 349% reached in June 2022.

Chart 4

Is This Optimistic Scenario Possible?

Not all debt is bad. There are good reasons to take on additional debt. Emerging markets are still climbing the economic development ladder. Many governments may help more vulnerable peoples and businesses to cope with surging food and energy prices. Governments, corporates and households will have to pay for more frequent extreme weather events and climate change mitigation. Countries will need to develop new infrastructure to adapt to a low-carbon and digital economy.

Leverage can’t grow forever. As Carl Jung said: “No tree, it is said, can grow to heaven unless its roots reach down to hell.” Avoiding the hell of a debt crisis may require ensuring only productive new debt is deployed, writing down unproductive debt, curbing overconsumption and restructuring loss-making enterprises. These actions may not be popular. A “Great Reset” of community acceptance of more judicious spending and policymaker caution about debt may be needed. There is no easy way out.

Next Article:

Crunch Time: Can Adaptation Finance Protect Against the Worst Impacts From Physical Climate Risks? >

This article was authored by a cross-section of representatives from S&P Global and in certain circumstances external guest authors. The views expressed are those of the authors and do not necessarily reflect the views or positions of any entities they represent and are not necessarily reflected in the products and services those entities offer. This research is a publication of S&P Global and does not comment on current or future credit ratings or credit rating methodologies.