ESG: Part I

Environmental, Social, And Governance: Why Corporations' Responses To George Floyd Protests Matter

The issue of racial inequality is not new, but the flurry of reactions from the usually reticent corporate sector is. The huge number of demonstrators calling for justice and change--among them customers, suppliers, and shareholders--has put the onus on corporate leaders to show how their policies are contributing to a more equitable and inclusive workplace. Companies have also been quick to take a stand after video clips of incidents involving employees flooded social media. Many have also publicly condemned discrimination, pledging to review policies and committing to diversity and inclusion initiatives.

Key Takeaways

- Stakeholders are increasingly holding companies to a higher social standard, demanding that they demonstrate a real commitment to advancing racial equality, beyond donations and promises.

- S&P believes racial injustice is becoming a material issue that has the potential to change our ESG Evaluations and credit perspectives, although the full effects are not yet clear.

- The sheer scale of demonstrations against racism and social injustice after George Floyd's death has led some corporations to publicly denounce all forms of discrimination, and we expect this will continue.

- Companies' values and discrimination records are under intense scrutiny, prompting responses from 217 S&P 500 companies as of June 25, 2020, to protect their reputations and businesses, particularly from negative comments on social media.

ESG: Part II

Diversity And Inclusion As A Social Imperative

The Black Lives Matter movement has pushed the long-standing issue of systemic racism to the fore. Stakeholders' increased awareness and activism are pushing corporate transparency and accountability to unprecedented levels. As customers, employees, and shareholders are opening their eyes to the reality of what the Black community faces, they are calling on corporates to address discrimination within their organizations

Diversity May Increase as Pandemic Lifts Financial Services' Remote Work Stigma

Attitudes toward remote working in financial services have changed as a result of the COVID-19 pandemic, and as banks plan for a more flexible working environment, they see an opportunity to increase diversity in their organizations.

Julius Bär Gruppe AG has managed to serve clients with 90% of staff working remotely during the crisis, the Swiss bank's CEO, Philipp Rickenbacher, said during its second-quarter earnings call. He spoke about fundamental changes to the way of working in wealth management and the wider financial services industry.

Read the Full Article

Equality

Public focus on equality opens doors for some Black-owned banks

The number of Black-owned banks in the U.S. has been dwindling, but recent regulatory changes and momentum to fight social injustice are creating some tailwinds for the minority depository institutions.

Data Transparency 'Key' to End Racial Disparities in Insurance, Regulator Says

California's state insurance commissioner is working toward regulatory reform after his department found "disturbing inequity" among group affinity discounts that insurers offer in the state.

A focus on the role of big data, artificial intelligence and other advanced technical tools is necessary to make sure discrimination, intentional or unintentional, does not take place, the regulator said.

Ratings

The ESG Pulse: Social Factors Could Drive More Rating Actions As Health And Inequality Remain In Focus

The impact of the pandemic on credit quality has directly influenced close to 1,200 ESG-related rating actions during April and May. We classify the pandemic as a health and safety-related social factor in our rating actions, if we believe health concerns and social-distancing measures directly affect the entity.

Key Takeaways

- Of the close to 1,200 ESG-related rating actions during April and May, 98% were triggered by the COVID-19 pandemic. The pandemic has highlighted the importance of social factors, which could drive more rating actions given the increased awareness and credit relevance of health issues, diversity, inequality, and social unrest.

- The sectors most directly affected by the pandemic have been governments and corporates. Within corporates and infrastructure, airlines and airports, hotels, entertainment, automotive, nonfood retail, and commercial real estate saw the highest share of ESG-driven rating changes.

- For U.S. public finance, the public transport, not-for-profit airports, and higher education ratings have been most affected, while some governments are facing more elevated social risk based on protests and community unrest.

- Structured finance transactions most affected are business securitizations (e.g. pubs, fast-food restaurants, gyms, stadiums, leisure parks), dealer floorplan and rental car ABS, aircraft ABS, and CMBS with hotel and retail exposure.

#ChangePays

Women in Metals and Mining

From laws preventing women working in specific jobs to the stereotyping of gender roles and abilities, the metals and mining sectors have historically been inhospitable environments for women to enter and progress in their careers.

Now, long overdue change is happening in the industry, but there is still much work to be done, thirteen female leaders told S&P Global Platts in our latest #ChangePays report

Watch a Summary:

Changing Workplaces

People Power: COVID-19 Will Redefine Workforce Dynamics In The Post-Pandemic Era

With the onset of the COVID-19 pandemic earlier this year, companies around the world have faced the gravest disruption in more than a generation, with a variety of sectors facing an existential threat amid a severe economic downturn--an uncertain prospect given the mixed signals on policy and challenges forecasting the spread of a novel disease.

Listen:The Power Of Stakeholder Pressure: How Companies Are Responding To Systemic Racism

Co-hosts Corinne Bendersky and Mike Ferguson discuss the Black Lives Matter movement and how it’s translating into calls for greater racial equity in the workplace.

S&P Global CEO Doug Peterson and Funmi Afonja share their unique perspectives on the BLM movement and how employees, companies, and society at large are confronting the reality of racism.

As a leader in data, analytics & insights in financial markets, we have a unique perspective on the role women play in transforming markets & economies. We have found that a larger role for women pays off for economies & markets in tangible ways.

Learn More About #ChangePaysGreen Bonds

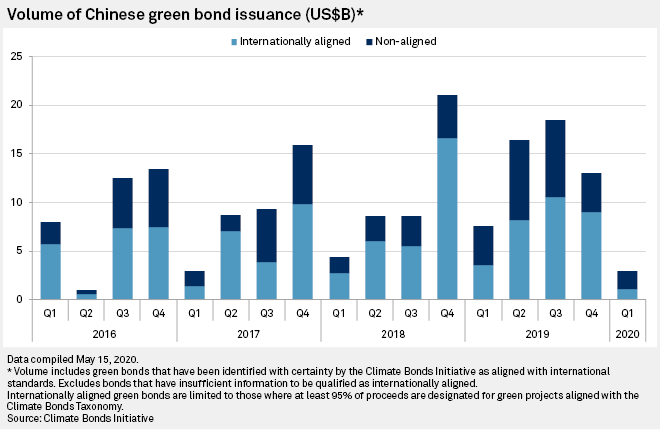

China's green bond market rebounds after COVID-19 rout; social bonds surge

The COVID-19 crisis has dented demand for green bonds in China, one of the world’s largest issuers of the debt that finances environmentally friendly projects.

Listen: The Growing Importance of ESG in the Commodities Space

The death of George Floyd in the US on May 25 significantly raised global awareness of racial and cultural issues.

S&P Global Platts Head of News for Asia Mriganka Jaipuriyar discusses these issues with Platts APAC Head of Metals News and Insight Paul Bartholomew, and S&P Global Ratings Associate Director, Corporate Ratings, Minh Hoang.

Sustainable Debt

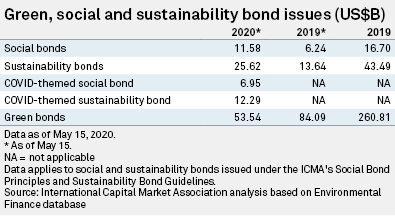

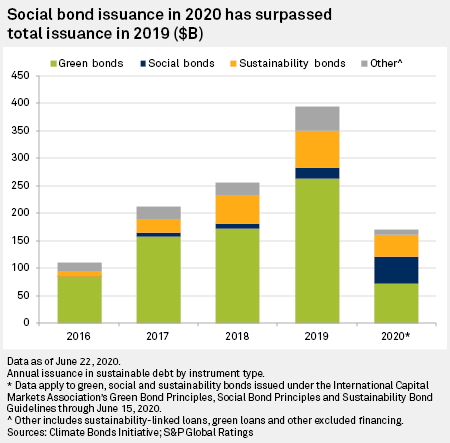

A Pandemic-Driven Surge In Social Bond Issuance Shows The Sustainable Debt Market Is Evolving

Corporations and financial institutions will become more active in the social bond market as the pandemic accelerates private issuers' interest in social considerations.

While significant steps have been made to standardize social bond disclosure and reporting, S&P Global Ratings believes issues persist and improvements have been slow to proliferate.

Key Takeaways

- We expect social bonds to emerge as the fastest-growing segment of the sustainable debt market in 2020. This stands in sharp contrast to the rest of the global fixed income market, for which we expect issuance volumes to decline this year.

- We believe recent growth in social bond issuance indicates that the COVID-19 pandemic has not turned issuers' or investors' attention away from sustainable finance, but rather interest seems to be growing.

- Corporations and financial institutions will become more active in the social bond market as the pandemic accelerates private issuers' interest in social considerations.

- While significant steps have been made to standardize social bond disclosure and reporting, we believe issues persist and improvements have been slow to proliferate.

To facilitate long term, sustainable growth, it is imperative to analyze the environmental, social and governance (ESG) performance of companies and examine how activity in the markets influences the world in which we live.

Learn more about our ESG capabilitiesSocial Bonds

Social Bond Surge Appears Here to Stay as COVID-19 Crisis Shifts Funding Needs

The COVID-19 pandemic has led to surging demand for bonds that finance social projects. Market participants say this spike is likely to last beyond the crisis as the coronavirus has given the social bond market a sense of purpose and clear goals that it previously lacked.

<

As Emerging Markets Stagger, Pandemic Spurs Social Bond Issuance

The coronavirus pandemic is spurring emerging market governments to issue social bonds, using the proceeds to fund their response to COVID-19, which could help establish such instruments as a popular asset class.

Further Reading

More of our ESG coverage

– Climate Risk and Energy Transition

– The Growing Importance of 'S' & 'G' in ESG – ESG in the Time of COVID-19 – All division coverage from S&P Global