Discover more about S&P Global’s offerings

Published: February 8, 2021

In response to demand and regulatory drivers, the quality and quantity of ESG data will continue improving. Meanwhile, in the U.S., the new Biden administration will reinvigorate ESG policies and climate urgency.

With this growing global urgency around climate, conversations about energy transition will become increasingly nuanced and the nature of transition conversations will shift from climate mitigation to climate resilience.

While threats to nature and biodiversity will take centerstage in ‘E’ discussions, social issues will gain traction with investors and in global policy discussions.

In 2020, the world learned a hard lesson: Despite our best-laid plans, we don’t know what is immediately around the corner. In 2021, that lesson reinforces our view that a long-term, sustainable approach centered around strong environmental, social and governance (ESG) principles is more important than ever.

Here are some of the seven ESG trends we expect will shape the sustainability agenda in the months — and years — ahead.

1. Data Improvement 2. Biden Administration Impacts 3. Threats to Nature and Biodiversity 4. Increasingly Nuanced Conversations 5. Shift to Climate Resilience 6. Investors and Social Issues 7. Global Traction of Social Issues

As many countries and supervisory authorities in the financial system begin to require climate risk disclosures, we expect continued drive towards transparency around climate in the lead up to the United Nations Climate Change Conference, or COP26, taking place in Glasgow in November.

The world’s largest asset managers are taking a proactive stance on issues across the ESG spectrum, and that will continue to drive discussions around disclosure and data quality. In his annual letter released last week, BlackRock’s Larry Fink urged companies to disclose how they are preparing for a "net zero world" where net greenhouse gas emissions are eliminated by 2050.1 At State Street Global Advisors, the main stewardship priorities in 2021 will be the systemic risks associated with climate change and a lack of racial and ethnic diversity on company boards.2

Simultaneously, a number of international and regional policy and regulatory initiatives are driving in the same direction. The IFRS Foundation’s proposals around sustainability reporting represent an important international attempt to make progress on disclosure.3 The Network for Greening the Financial System is also coordinating best practice in the world of financial supervision of climate-related risks. The new sustainability disclosure requirements for market participants in the EU under the Sustainability Disclosures Regulation and the Taxonomy have created new impetus for better ESG information and data. The review of the EU’s Non-Financial Reporting Directive this year aims to provide companies with a streamlined framework to report on ESG matters. The UK also has announced that it will make TCFD reporting mandatory.

Perhaps most importantly, companies are responding to the pressure. Earlier this month, Exxon Mobil was first US oil super major to disclose greenhouse gas emissions data related to customer use of its petroleum products. The company said it will provide Scope 3 emissions data reports annually.4

But data remains uneven, with a patchwork of reporting frameworks around the globe. About 90% of companies in the S&P 500® publish sustainability reports, but only 16% have any reference to ESG factors in their filings, creating a mismatch between what is disclosed in regulatory filings and what companies voluntarily publish.5

Standardization is lacking, and as a result, regulators across jurisdictions are facing pressure to address this gap. The private sector and companies like S&P Global can play an important role in facilitating international dialogue to align on better disclosure standards, which will lead to better ESG data. We are engaging to lend our expertise to these policy initiatives trying to find solutions.

Ultimately, agreement on standard definitions of ESG information will reduce reporting burden and will provide better and more meaningful ESG data to market participants to help them identify, compare and act upon ESG risks and opportunities.

The new administration in the U.S. brings a significant change in tone on addressing climate risk. On Day 1 in office, President Joe Biden took steps to rejoin the Paris agreement on climate change and pledged to set the U.S. on the path to net-zero greenhouse gas emissions by 2050 with an interim target of decarbonizing the U.S. power sector by 2035. Biden is expected to use his first 100 days to start the nation down that road and has committed to make climate policy, renewable energy and green infrastructure top priorities for the new administration.6

Furthering the U.S.’s position on climate risk, the Federal Reserve recently joined the Network for Greening the Financial System, a group of central banks and supervisory authorities from around the world that are collaborating to develop climate risk management tools for the financial sector.7

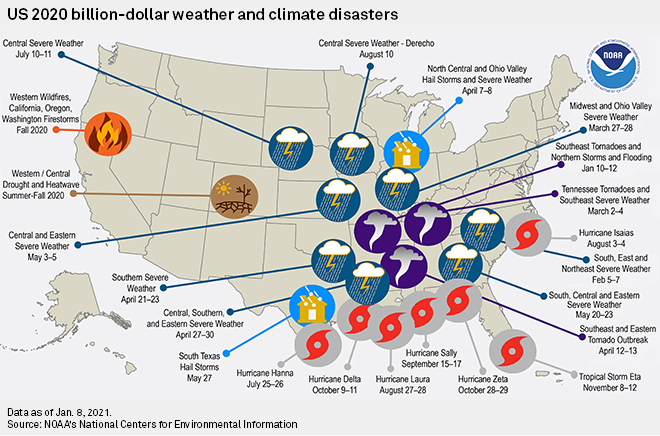

These moves come alongside stark evidence of the economic costs of climate change. According to S&P Global Trucost, almost 60% of the companies in the S&P 500 have at least one asset at high risk of physical climate change impacts. In 2020 the U.S. broke an unsettling record, experiencing 22 extreme weather and climate change-linked disasters that each cost in excess of $1 billion, according to figures recently published by the National Oceanic and Atmospheric Administration. Those events collectively caused at least $95 billion in damages, killed at least 262 people and injured scores more. Prior to 2020, the largest number of annual major disasters was 16.

Scientists project that as average global temperatures continue to rise due to human-caused greenhouse gas emissions the number and intensity of extreme weather events would rapidly increase.8 A 2020 report by S&P Global Ratings found that water scarcity will affect 38% of counties in 2050 under a high-stress climate scenario (RCP8.5), raising risks under this scenario for their municipal water utilities, public-owned power utilities, and local governments. Heat wave risk will continue to increase across all states and under all scenarios to midcentury with Florida particularly exposed.9

According to an S&P Global Trucost analysis of 3,500 companies representing 85% global market cap, 65% of company business models align with the United Nations Sustainable Development Goals (SDGs), but less than one percent of business models align with SDGs 14 and 15, “life below water,” and “life on land.” We expect this to change in 2021 with businesses shifting focus on growing threats to nature and biodiversity. The World Economic Forum estimates that $44 trillion of economic value generation representing more than half of world GDP is moderately or highly dependent on nature.

The Taskforce on Nature-related Financial Disclosures (TNFD) calls nature loss “a planetary emergency.” Similar to the Taskforce on Climate-related Financial Disclosures (TCFD), the TNFD working group of financial institutions, private firms, governments, regulators and think tanks aims to create a framework for corporates and financial institutions to assess, manage and report on their dependencies and impacts on nature.10

That discussion will continue and gain momentum throughout 2021. ‘How to Save the Planet’ was a theme of last week’s Virtual World Economic Forum in Davos, with sessions focused on biodiversity and ocean health.11In May, the United Nations Conference of the Parties (COP 15) to the Convention on Biological Diversity (CBD) will convene to review a strategic plan for biodiversity and likely to make a final decision on the post-2020 global biodiversity framework.12

I mentioned in my last letter that we saw an absolute explosion of net-zero commitments from companies and countries surrounding the 5th anniversary of the Paris Agreement. With these new pledges, the United Nations estimated that by early 2021 countries representing around 65% of global CO2 emissions and around 70% of the world's economy will have committed to reaching net-zero emissions or carbon neutrality.13 This is especially relevant when considering that the S&P 500 is on a CO2 emissions trajectory that implies a more than 3°C temperature rise globally, according to S&P Global Trucost.

China, which represents nearly 30% of global CO2 emissions, committed to halt its rise in carbon emissions before 2030 and become carbon-neutral by 2060. That will be no simple feat. S&P Global Platts analysts say that for China to reach net zero, “an unprecedented shift in the energy mix would need to take place” as fossil fuels currently account for 85% of its energy consumption.14

These ambitious targets mean companies and investors will be having some difficult discussions around the energy transition in 2021. As Laurence Pessez, head of corporate social responsibility at one of France's largest banks, BNP Paribas, put it: “It's obvious that we will have to exit the relationship with at least 30% to 50% of our current clients in the power generation business.”15

As the planet looks to “build back better” after the pandemic, we expect conversations to shift from simply mitigating the negative effects of climate change to include more discussion about adaptation and climate resilience.

Some groups are already working to address this, like the Coalition for Climate Resilient Investment. CCRI seeks to build on TCFD disclosures by finding practical ways to integrate physical climate risks into investment decision-making.16

Looking ahead, we also see that rebuilding from the pandemic presents opportunities for capital markets. In Europe, for example, 30% of the €750 billion recovery fund is dedicated to green and sustainable. With so much government-issued debt that will be tagged to sustainability, private markets are likely to crowd in, creating a boom in sustainable debt.17

After a record year for sustainability-related debt issuance, demand for sustainable and green bonds is set to "go through the roof" in 2021. According to S&P Global Ratings, global sustainable debt issuance is expected to surpass $700 billion in 2021, up from $500 million from 2020. With the increase in companies and governments making net-zero commitments, transition bonds are emerging as a potential solution by enabling carbon-intensive companies to raise capital and use the proceeds for activities that help them reduce their carbon footprint.

Conversations about disclosure are not limited to the ‘E’ in ESG. On the contrary, when the pandemic hit it brought widespread social unrest around income inequality and worker safety. The death of George Floyd while in police custody put a necessary spotlight on the ugly systemic racism that for so long has gone unspoken in the U.S. Amid this upheaval the ESG conversation evolved rapidly as investors, corporates and the public gave more priority to social issues — the ‘S’ in ESG.

In 2021, we expect that focus will intensify, and data will evolve as a result.

Often when we talk about diversity, we talk about gender— a data point that is frequently easier to measure than other kinds of diversity. There is evidence that gender diversity improves results. S&P Global Market Intelligence’s Quantamental Research team looked at companies from year-end 2002 through May 31, 2019, and found that those with female CFOs generated $1.8 trillion more in gross profit than their sector average. Companies with female CFOs also experienced bigger stock price returns relative to firms with male CFOs during the executives' first 24 months in the role, the analysis found.18

The definition of diversity is evolving beyond just gender as investors and corporates expand their expectations.

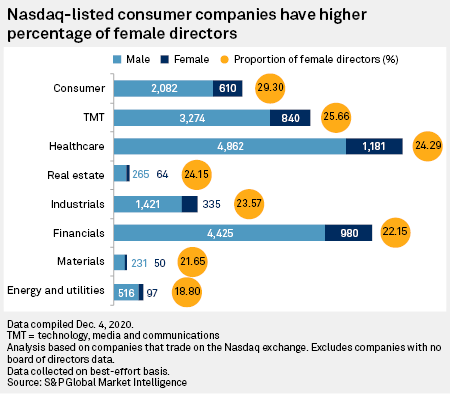

In December 2020, Nasdaq proposed a rule that that will require most of its more than 2,500 listed companies to have at least one director in the coming years who identifies as a woman and another who is Black, Hispanic, Native American, LGBTQ+ or part of another underrepresented community. Data on the race and sexual orientation of board members remains scarce, making it difficult to determine how many Nasdaq-listed companies currently comply with the diversity proposal. But an initial S&P Global Market Intelligence analysis of board gender diversity found that roughly 18% of the 2,707 companies listed at Nasdaq do not have a female director.19

Within S&P Global, we’re taking steps to correct enhance race-related data too. As a start we added a question regarding the number of board members from minorities to the 2021 S&P Global Corporate Sustainability Assessment.

We’re also seeing social issues coming to the fore in policy worldwide.

In Europe, after years of debate in politics and business about the best way to facilitate equal opportunities, German lawmakers backed a bill mandating female representation at the board level in the largest companies. It will make Germany one of the few countries in Europe with this kind of gender mandate.20

In the U.S., some states have gone a step further. Corporate diversity laws enacted in Illinois in 2019 and in California in September 2020 aim to make publicly traded companies embrace racial diversity on their boards, and in March for the first time the University of Illinois will publish a report card evaluating how public companies headquartered in the state are faring.

And at the federal level, Biden's $1.9 trillion economic relief package includes proposals to bolster safety regulations for workers and expand the amount of paid sick, family and medical leave workers can receive. It comes at a time when many employees are struggling to care for children or loved ones amid widespread closures of daycares, schools and nursing homes.21

Family leave policies in the U.S. lag the rest of the developed world. The U.S. is the only country within the Organization for Economic Cooperation and Development that does not offer nationwide, statutory, paid family leave of any kind, whether maternity leave, paternity leave or parental leave, according to a 2019 UNICEF report on family-friendly policies. In addition, the federal government does not provide paid caregiving leave to its citizens nor mandates companies to do so.22

While a number of states have enacted paid family leave laws during the pandemic, the U.S. private sector has largely taken the lead in such policies in the absence of federal mandates, 2020 research conducted as part of S&P Global’s #changepays initiative found. Many parents and family caregivers saw their at-home commitments grow since the pandemic began, leading to increased stress and some feeling that they were being penalized at work for their increasing responsibilities, according to an S&P Global/AARP survey of nearly 1,600 people conducted in the late summer of 2020.23

We cannot know with certainty what is right around the corner, however, the events of this past year reinforced the importance of taking the long view — putting in place both policies and business strategies that look beyond next quarter or next year to create just, equitable and sustainable societies that will thrive over the next several decades and beyond. And that means understanding ESG risks and opportunities is a focus that we are invested in for the long haul.

Endnotes