Join S&P Global for a comprehensive analysis of varying Russia/Ukraine conflict scenarios during a period of economic uncertainty. Paul Gruenwald, Global Chief Economist, S&P Global Ratings will outline key macroeconomic observations and the possible paths the conflict could take.

Watch the ReplayOverview

Russia-Ukraine War: One Year On

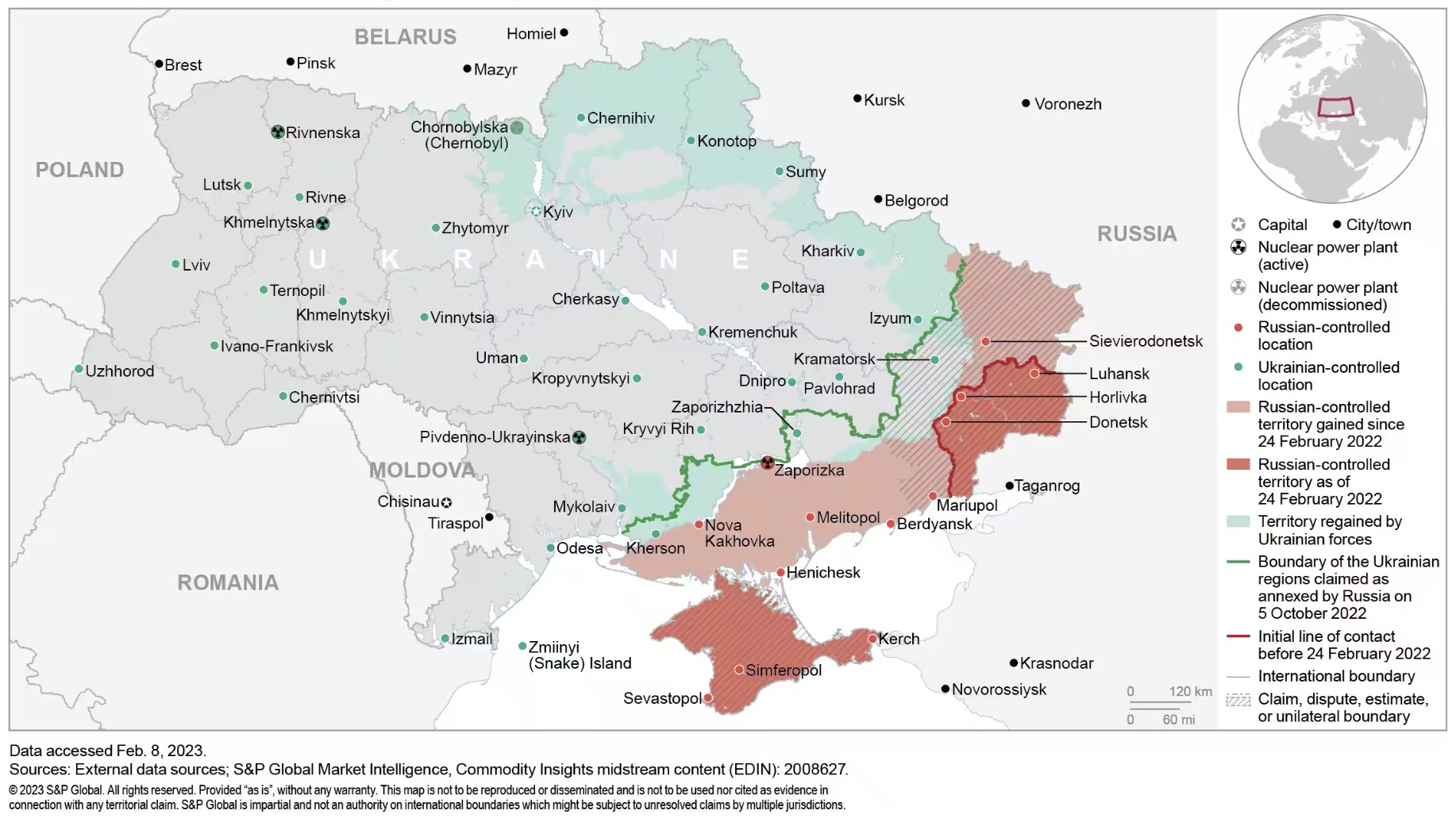

Russia is continuing its bombardment of Ukraine, with the conflict now nearly a year on, to wear down the Ukrainian population's support for the war and initiate ceasefire negotiations that would freeze the 1,000-km line of contact.

Russia’s Invasion of Ukraine (Feb. 8, 2023)

Saudi Arabia to Host Ukraine Peace Talks

Saudi Arabia is set to host Ukraine peace talks in the western coastal city of Jeddah in early August, a senior official told S&P Global Commodity on July 30. The move by the world's largest oil exporter could have a significant impact on the oil, grains and other commodities markets.

Read the articleRussia-Ukraine Military Conflict: Key Takeaways From S&P Global Ratings

The Russia-Ukraine military conflict could have profound effects on macroeconomic prospects and credit conditions around the world. Leading up to, and during, the conflict, Western countries announced stringent sanctions on Russian entities and individuals.

Read the ReportReceive immediate insights on the individual market developments you need to know for a 360° perspective on the big stories shaping our world.

SUBSCRIBE TO OUR NEWSLETTERSCapital Markets

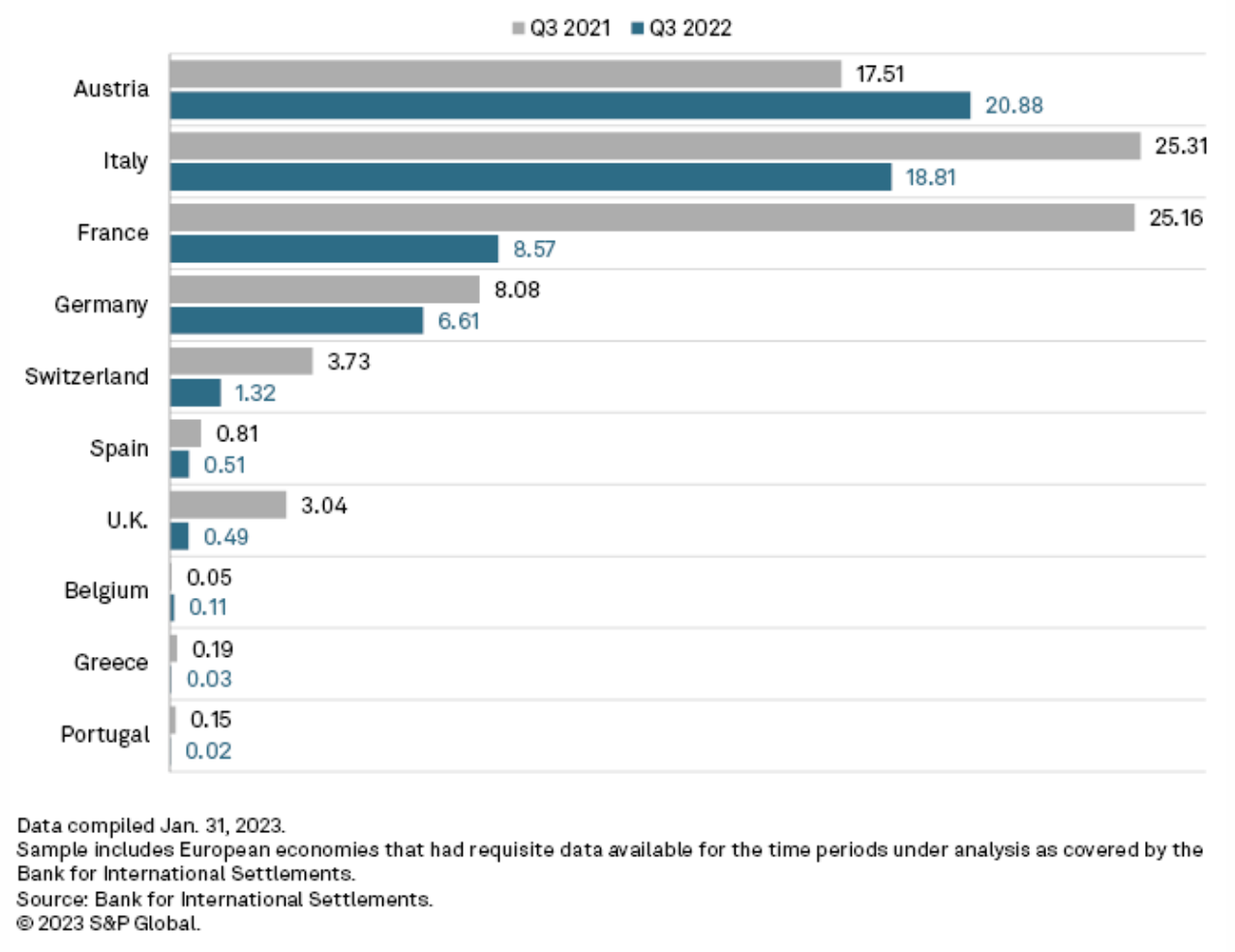

Russia-Ukraine War Splinters Europe's Banking Industry

The war in Ukraine has prompted a rupture between the Russian and European banking systems, heightening risks for lenders on both sides of the divide.

Outstanding Claims to Russia of Select European Economies ($M)

U.S. Banks Face Deposit Outflows; Insurers Strive To Gauge Ukraine War Cost

Regulators' increased focus on Community Reinvestment Act compliance has trickled down to merger review and could explain why bank deals are facing closing delays, industry experts said. After three consecutive quarters of runoff, the industry is wrestling with additional declines in 2023 and funding costs that are likely to keep going up even after the Fed pauses interest rate hikes.

Read the ArticleInsurers Unable To Tally Up True Cost Of Ukraine War

The insurance industry is struggling to gauge the cost of Russia's war with Ukraine a year after the conflict began. Exposures far removed from the war itself have been unearthed, while insurers are unable to count the cost of claims across their political risk, marine and aviation business lines. Those covered by the political violence market, such as physical damage to buildings, are also proving difficult to quantify.

Read the ArticleThe Russian invasion of Ukraine has not only initiated a global humanitarian crisis, it’s given rise to greater risk exposures in capital flows, trade and commodity markets worldwide. Our experts are sensitive to the effect of the conflict on global economies as well as its impact on our community in deep and varied ways.

READ MOREMetals & Mining

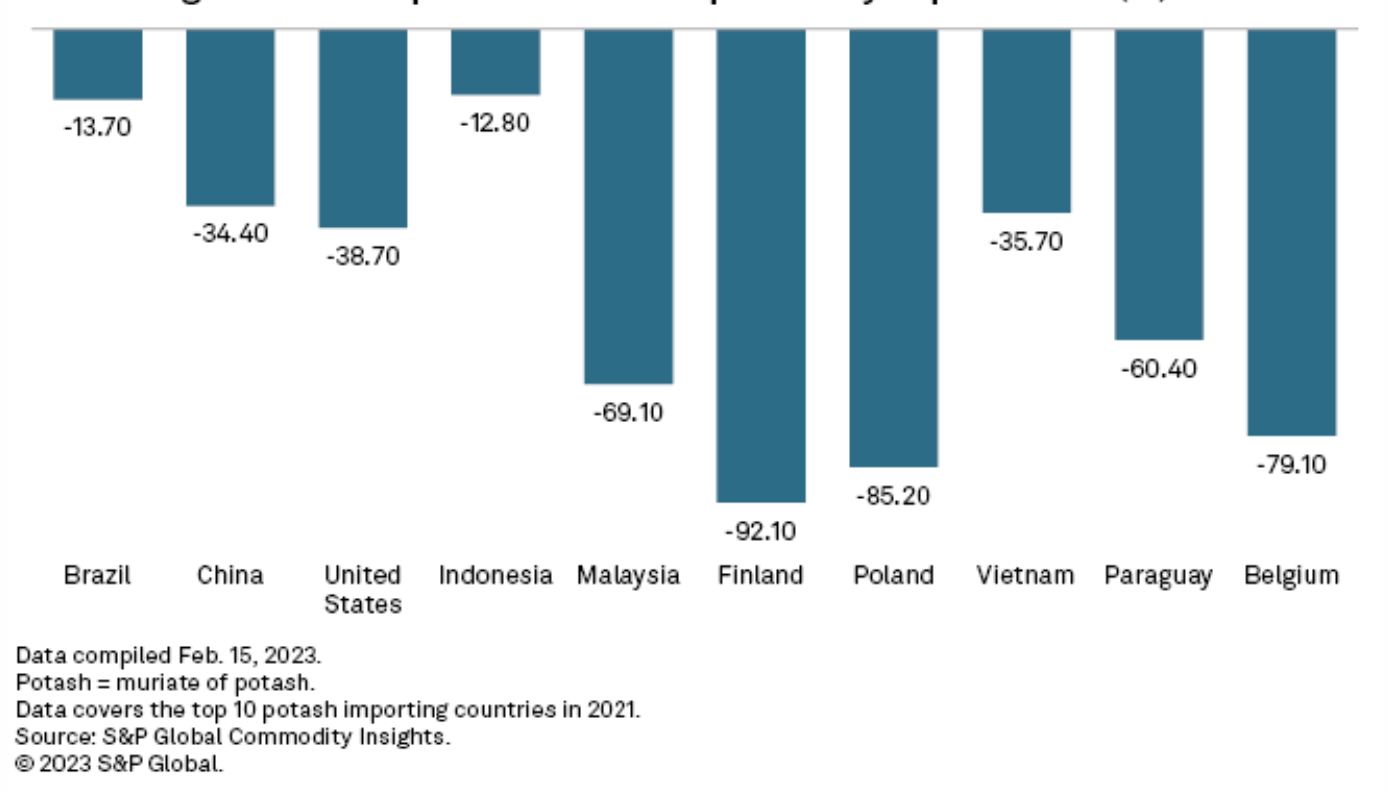

Metals And The Invasion: Russian Potash Exports Rebound, Expansion At Risk

Russia's fertilizer exports have rebounded from the fallout of the country's February 2022 invasion of Ukraine, calming the panic over potential supply deficits and raising expectations that Russia will continue exporting potash at close to pre-war levels.

However, the country's expansion plans have been disrupted and customers are looking to other potash producers to diversify their supply chains.

Russia and key ally Belarus have typically accounted for about a third of the potash market in recent years. Canada, another top producer, also supplies about a third of the global market.

In the year since the invasion of Ukraine, Russia has continued to supply the market at roughly 85%-90% of its usual capacity, analysts told S&P Global Commodity Insights. There has been some self-sanctioning, especially by European and U.S. buyers, but otherwise top potash consumers such as Brazil have largely continued to buy Russian product.

The invasion's most lasting impact for the potash market will be on trade flows, according to analysts and industry executives. Canada will likely fill some gaps as buyers avoid Russian product, especially in the EU and the U.S.

"What we're talking about is not a change in supply-demand dynamics," said Ben Isaacson, a Scotiabank fertilizer analyst. "We're actually talking about change in trade flows. It's just musical chairs."

YOY Change in 2022 Imports of Russian Potash By Top Markets (%)

Game Changer: Ukraine War to Transform Global Pig Iron Trade for Years to Come

The Russian invasion in Ukraine sent shockwaves to most commodities markets worldwide. With Ukraine and Russia accounting for around 60% of global merchant pig iron exports, the war has been a complete game changer for the global pig iron trade.

Read the articleMetals And The Invasion: Russian Metals Face Shaky 2023 As China's Demand Cools

China stepped up as a willing trade partner to Russia when some major world economies turned away from the latter's products after the invasion of Ukraine, but Russia's ability to continue to move metals out of its borders will heavily depend on economic conditions in China through 2023.

Read the ArticleMetals And The Invasion: Nornickel Loses Partners Amid War, Seeks New Suppliers

The world's largest producer of palladium and high-grade nickel will spend 2023 building new relationships after it lost access to capital and key logistics chains when Russia invaded Ukraine.

Read the ArticleMetals And The Invasion: Rusal Outruns Sanctions, Plans Expansion

Russian aluminum giant United Co. Rusal IPJSC is looking ahead to expanding operations and selling its low-carbon product into China after booking an estimated 10.6% increase in net income in 2022, according to S&P Global Market Intelligence data.

Read the ArticleShipping & Sanctions

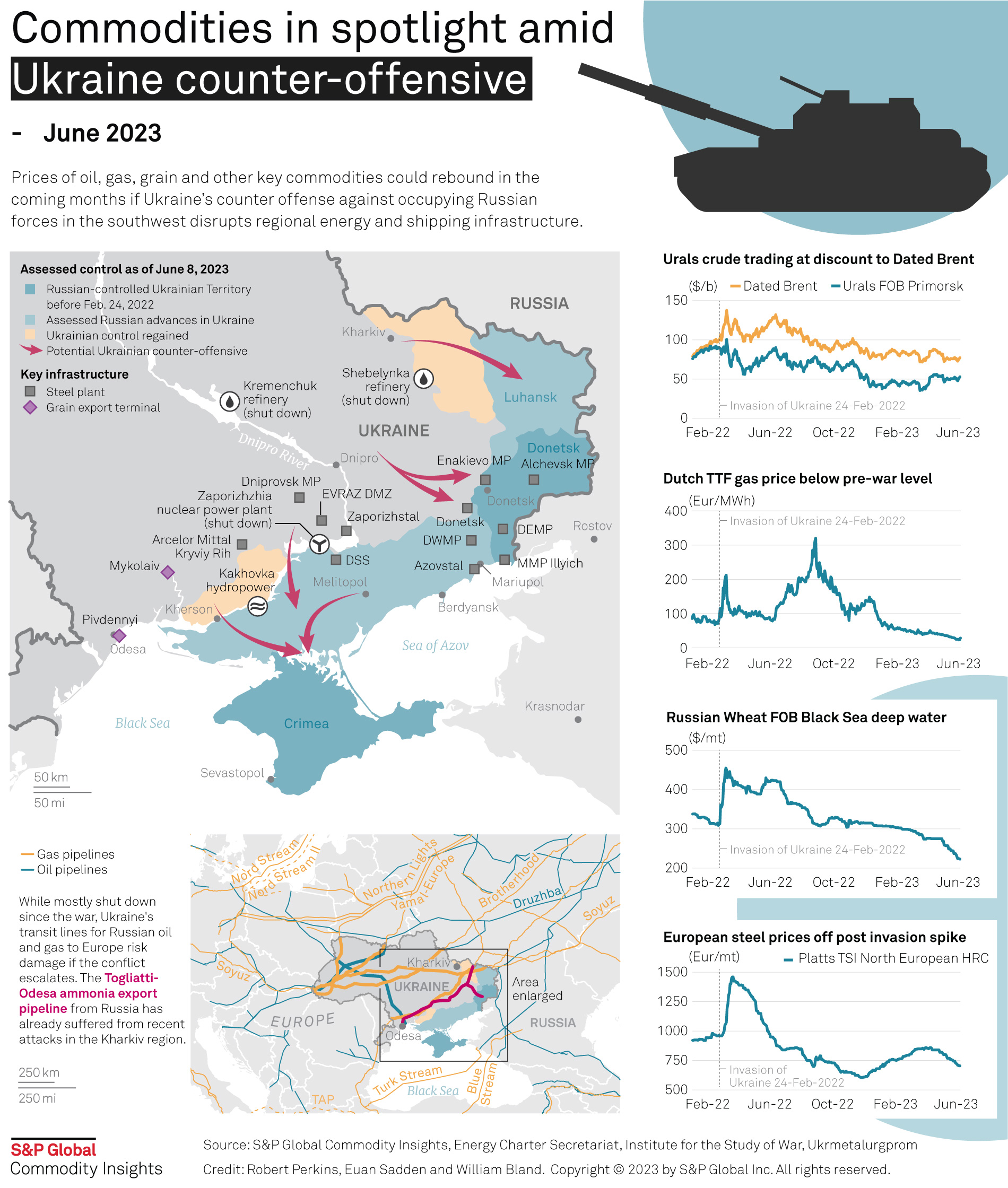

Ukraine Counter-Attack Shows Permanent Shift in Commodity Flows

Ukraine's military has launched its long-awaited counter-attack to evict Russia, the world's second-largest oil exporter, from its territory, with battles raging in the Donbas area this June potentially deciding the fate of the conflict which began when Moscow's forces invaded last February.

Russia Reshaping Africa Energy Links After Ukraine Invasion

Russia's invasion of Ukraine has led to changes in its energy cooperation with African countries -- once touted as a priority target for future upstream investment abroad.

Western sanctions are making alternative energy partners and markets, including Africa, increasingly important for Russia.

US Increases Pressure On Russia With 200% Aluminum Tariff

The US will apply a 200% ad valorem tariff on imports of aluminum and derivative aluminum articles from Russia beginning on March 10 as it continues to increase pressure on Russia's economy in response to its continued invasion of Ukraine, the White House said Feb. 24.

Read the articleAsia HSFO Market Likely To Garner Strength As Traders Shun Sanctioned Russian Oil

The Asian high sulfur fuel oil market is likely to strengthen, and quite significantly so, from prevailing levels as oil majors and trading giants begin to increasingly eschew Russian-origin oil, traders said.

Read the ArticleIn response to Russia’s invasion of Ukraine, S&P Global Ratings continues to assess the effect on economies, markets, and credit.

ACCESS THE RESEARCHOil & Gas

One Year Of Ukraine War Prompts Sweeping Shifts In Asian Oil Flows

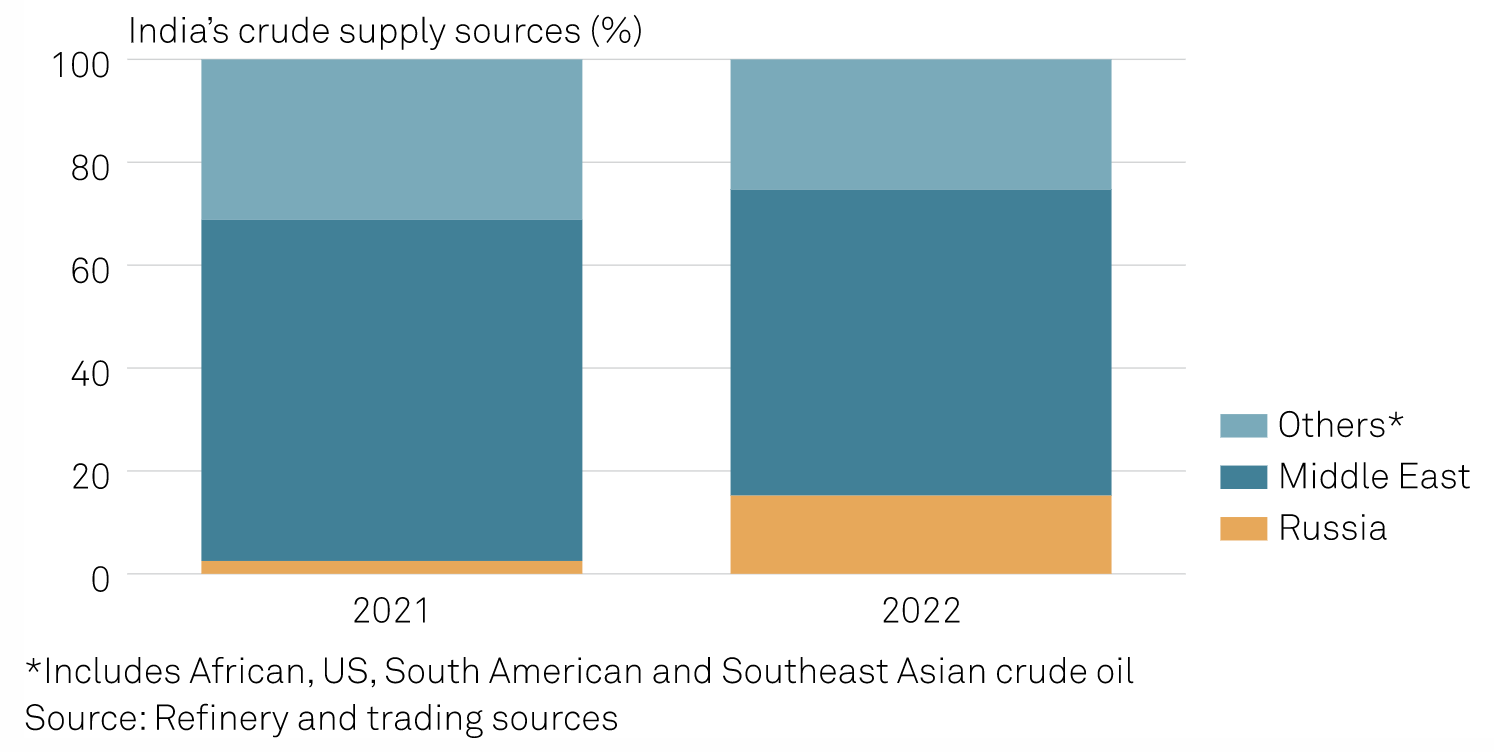

From OPEC's market share in India's imports falling to a decade low to China's appetite for Russian crude posting double-digit growth, one year of conflict between Russia and Ukraine has dramatically altered Asia's oil flow map.

As Moscow witnessed sanctions and restrictions, plentiful availability of discounted Russian crudes whetted the appetite of import-dependent Asia, which saw it as an opportunity to bring in as many cargoes as possible to cushion the impact of sky-high global energy prices.

The trend is expected to continue in 2023. The first sign of that was visible in January numbers. According to data from S&P Global Commodities at Sea, Russian seaborne crude exports hit an eight-month high in January, with exports to China and India hitting record highs of 1.12 million b/d and 1.3 million b/d, respectively.

And in 2023, the overall volume of oil shipments from Russia to Asia is expected to rise since more Russian oil products are expected to flow, in addition to the robust volumes of crude, as the EU ban on Russian products came into effect on Feb. 5.

Share of Russian Crude Oil in India’s Refinery Feedstock Import Basket Rises Sharply

Ukraine Rules Out Taking Part in New Russian Gas Transit Talks: Minister

Ukrainian energy minister German Galushchenko has ruled out the prospect of Kyiv taking part in any talks with Russia regarding arrangements for gas transit after the existing five-year agreement expires at the end of 2024.

Read the articleRussian Oil Tanker Attacked in Black Sea Near Crimea

A Russian tanker carrying fuel oil was attacked in the Black Sea near Crimea on Aug. 5 in the latest escalation of hostilities impacting commodities infrastructure stemming from Moscow's invasion of Ukraine. Authorities said the Sig tanker was struck just outside the Kerch Strait, which connects the Black Sea and the Sea of Azov, separating Crimea and Russia's Taman peninsula.

Read the ArticleRussia Could Still Impose Sanctions Against Ukraine's Naftogaz: Gazprom CEO

Russia could still impose sanctions against Naftogaz Ukrayiny that would render relations between the Ukrainian company and Russian entities "impossible", Gazprom CEO Alexei Miller said July 6.

Read the ArticleJoin global leaders, policymakers and executives from across energy, climate, finance, technology and industry at CERAWeek 2024 for timely dialogue, shared learning and connection.

Register for CERAWeekAgriculture

Black Sea Agriculture Trade Tilts In Russia's Favor After One Year Of War In Ukraine

Russia's share of trade in the international agriculture markets has risen one year after it invaded Ukraine, with the country's wheat and sunflower oil exports overshadowing slowing Ukrainian volumes, an analysis of trade data by S&P Global Commodity Insights showed.

Russia’s Wheat Exports Seen Rising, Ukraine’s Down

Ukraine Says Russia Hits Grain Facilities in Danube River Port

Russia has damaged grain warehouses while conducting drone attacks July 24 at the river port of Reni on the Danube expanding its target area, Ukraine said.

Read the articleTrends In Grains Market During Russian-Ukrainian War

The Russia-Ukraine war has had a significant impact on European countries. From the perspective of migration movements, Poland has received about 1.5 million refugees from Ukraine. Heavily dependent on Russian coal, gas, and oil, Europe is facing a major energy crisis. Laboriously rebuilt supply chains after the COVID-19 pandemic have been broken again and must be reorganized. The hostilities in Ukraine have also destabilized the global grain market.

Read the article