Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

China Plays the Long Game with Critical Minerals

Most of the economic news out of China focuses on youth unemployment numbers or the stressed property sector. While these issues are important, too much focus on the short term distracts from the structural advantages China has created through decades of strategic investment in critical minerals. Because of investments that began in the '80s, Chinese firms account for 60% of rare earths mining, 91% of refining and 94% of magnet production. According to a group of researchers from S&P Global, China is now expanding its critical mineral leadership through investment in developing countries.

Lithium, used in mobile phones, electric vehicles, renewable power and supercomputing, looks to be the key mineral for the next 20 years. With Chinese firms already in a dominant position in rare earth minerals, the global chase is on to lock down lithium supplies. In 2021, lithium prices hit historic highs before slowing global growth led to a softening of EV demand. However, S&P Global expects lithium demand to persist as technology companies and carmakers scramble to secure supply and reduce cost volatility. Besides lithium, nickel and cobalt are two other critical minerals for the energy transition that have attracted investment from Chinese firms.

China has jumped ahead in terms of EV adoption. EVs made up 15% of Chinese new car purchases in 2021 and the figure almost doubled to 27% in 2022. This rapid growth drove the prices of lithium, nickel and cobalt — which, together, account for 60%-70% of battery production costs — to skyrocket. Chinese auto original equipment manufacturers, confronting ballooning costs for raw materials, started investing upstream into mining and refining facilities as part of a backward integration push that led them to develop in-house battery technologies. These small investments allow the OEMs to establish strategic relationships with critical mineral providers without heavy capital outlays.

As competition for scarce lithium has heated up globally, many developed countries such as Australia and Canada have adopted stricter laws regarding foreign investment related to critical minerals. Chinese firms have responded by looking to developing countries in Africa and South America. S&P Global has tracked Chinese investments in Argentina, Chile, Namibia, Zimbabwe and the Democratic Republic of the Congo that pursue lithium, nickel and cobalt. However, even developing countries are beginning to restrict foreign investment. Mexico has nationalized its lithium industry and Chile is planning to nationalize its lithium reserves.

“The global chase for more control over critical minerals will raise China’s influence over industries that rely on these minerals as inputs,” according to a joint report by S&P Global Ratings and S&P Global Commodity Insights. “This reach may deepen and broaden as Chinese firms build sizable market positions as owners, producers or offtakers.”

Today is Tuesday, August 29, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

Economy

Malaysian Economy Moderates In Mid-2023

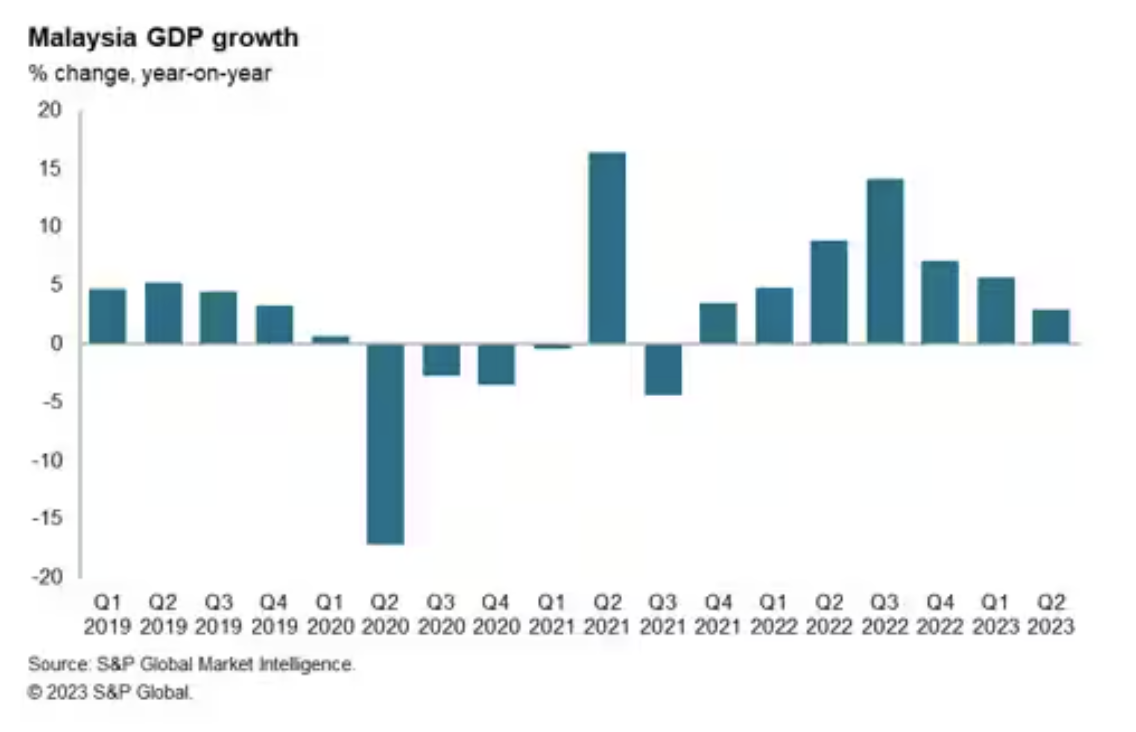

Malaysian economic growth moderated to a pace of 2.9% year-on-year (y/y) in the second quarter of 2023, compared to growth of 5.6% y/y in the first quarter of 2023. However, when measured on a quarter-on-quarter (q/q) basis, the pace of growth improved to 1.5% q/q in the second quarter of 2023, compared to 0.9% q/q in the first quarter of 2023.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Capital Markets

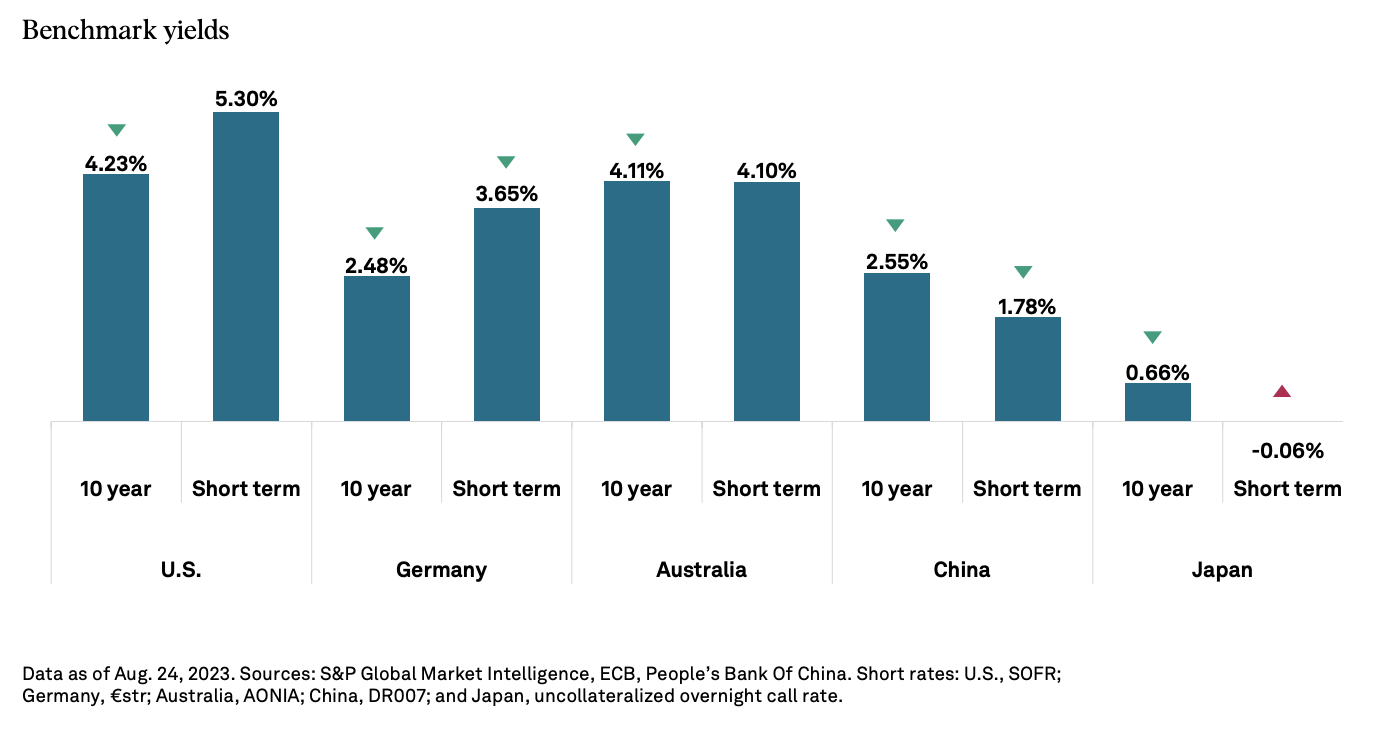

This Week In Credit: Contrasting Outcomes

Friday's observation from US Fed Chairman Jerome Powell that inflation remains “too high” seems to indicate that rates might go higher and/or remain higher for longer. Both scenarios will place further pressure on financing costs and refinancing risk, particularly at the lower end of the credit spectrum. Today's manageable refinancing picture — considering the $57 billion of 'B-' and lower-rated debt (as of July 1) coming due in the next 12 months — could become far more problematic as time passes, with the volume surpassing $201 billion and then $410 billion over a 24- and 36-month period.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

Global Trade

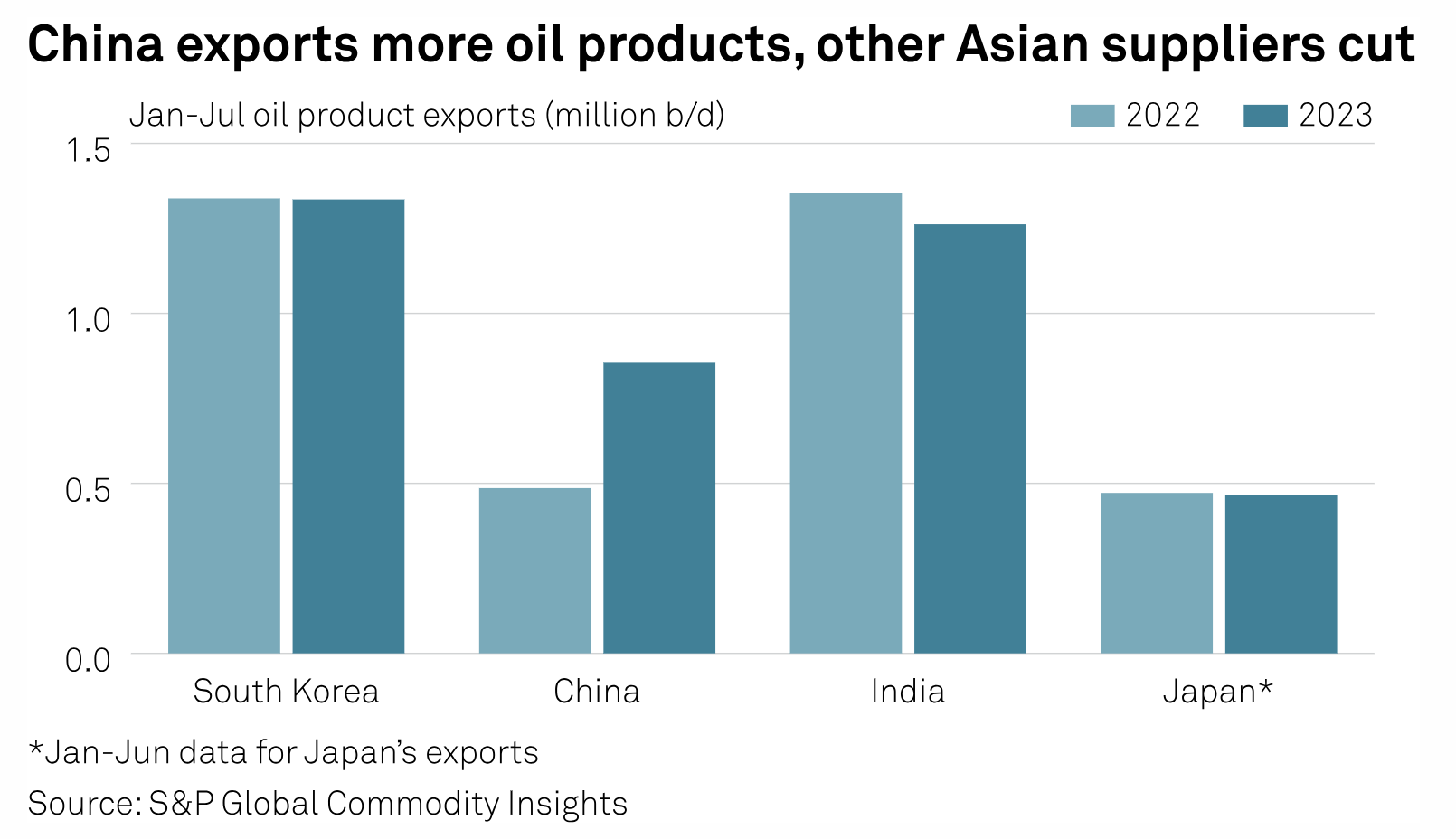

Beijing Issues New Oil Product Export Quotas To Encourage Outflows

China has issued new oil product export quotas to enable oil companies to send their surplus barrels overseas, senior officials with two quota holders said on Aug. 28. "The new allocation is out with Sinopec's volume topping among the quota holders, and we are arranging September exports. It looks [like there would be] no restriction on outflows for the rest of the year," an official with a state-owned company said.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Sustainability

Emissions Reduction Initiatives: What's In Store For Asia's Fertilizer Industry

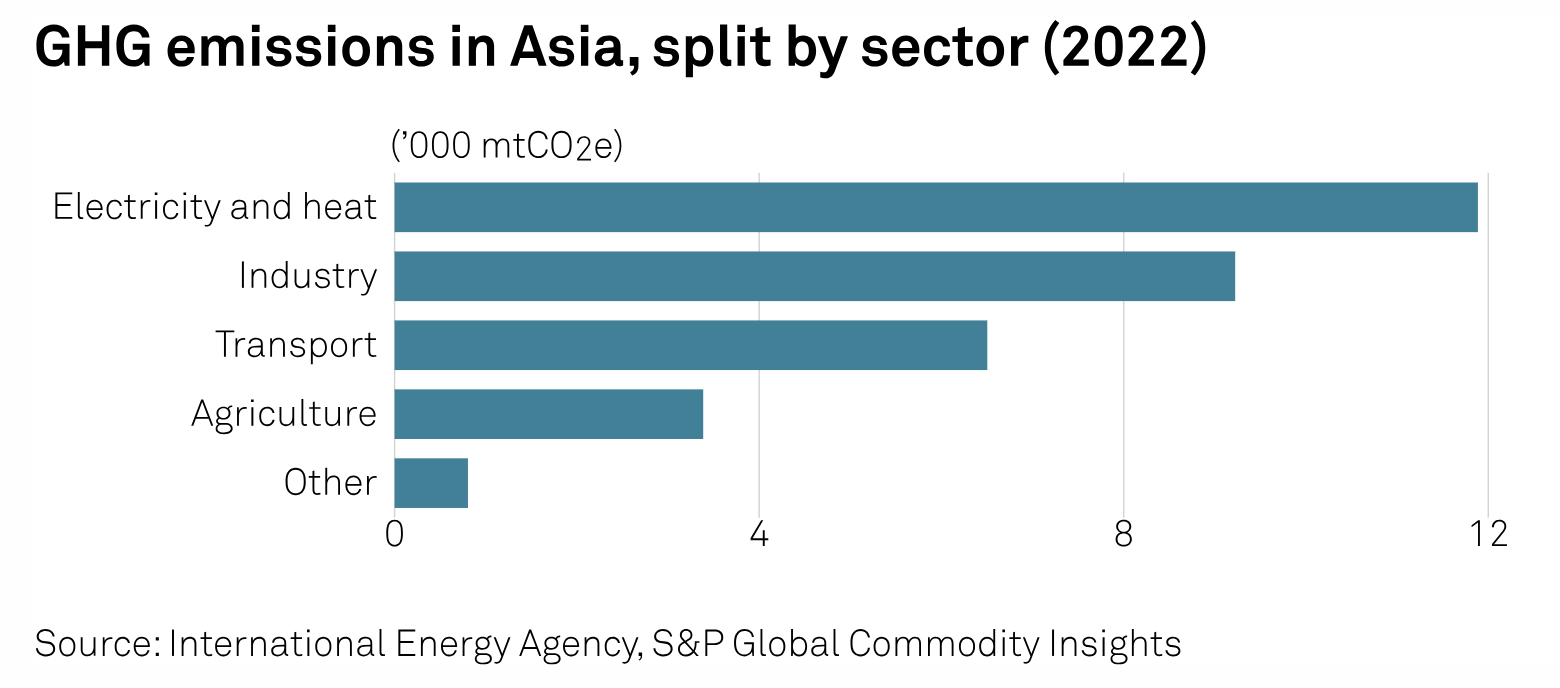

The Asia-Pacific region, home to almost 60% of the world's population, plays a significant role in global agriculture production. But the some of the region's agricultural practices, including the use of synthetic fertilizers and the increase in livestock production, have led to a substantial contribution to greenhouse gas emissions. Agriculture is Asia's fourth largest GHG emitter, contributing to more than 10% of the region's total emissions.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

Energy & Commodities

Listen: Is The Oil Market Ready To Say Goodbye To King Dollar?

The G7-led coalition’s price cap imposed on Russian crude is set to be tested as oil prices rise. At the same time, the greenback’s supremacy in global oil trade is being challenged. Rachel Ziemba, an adjunct senior fellow at the Center for a New American Security and global consulting firm Horizon Engage’s senior advisor on sanctions, delves into the sanctions and currency impacts on the oil markets on the podcast. She gives her take on the fate of the Russian oil price cap, the effects of price competition among sanctioned entities and whether we’re going to see the end of King Dollar anytime soon.

—Listen and subscribe to Capitol Crude, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

Technology & Media

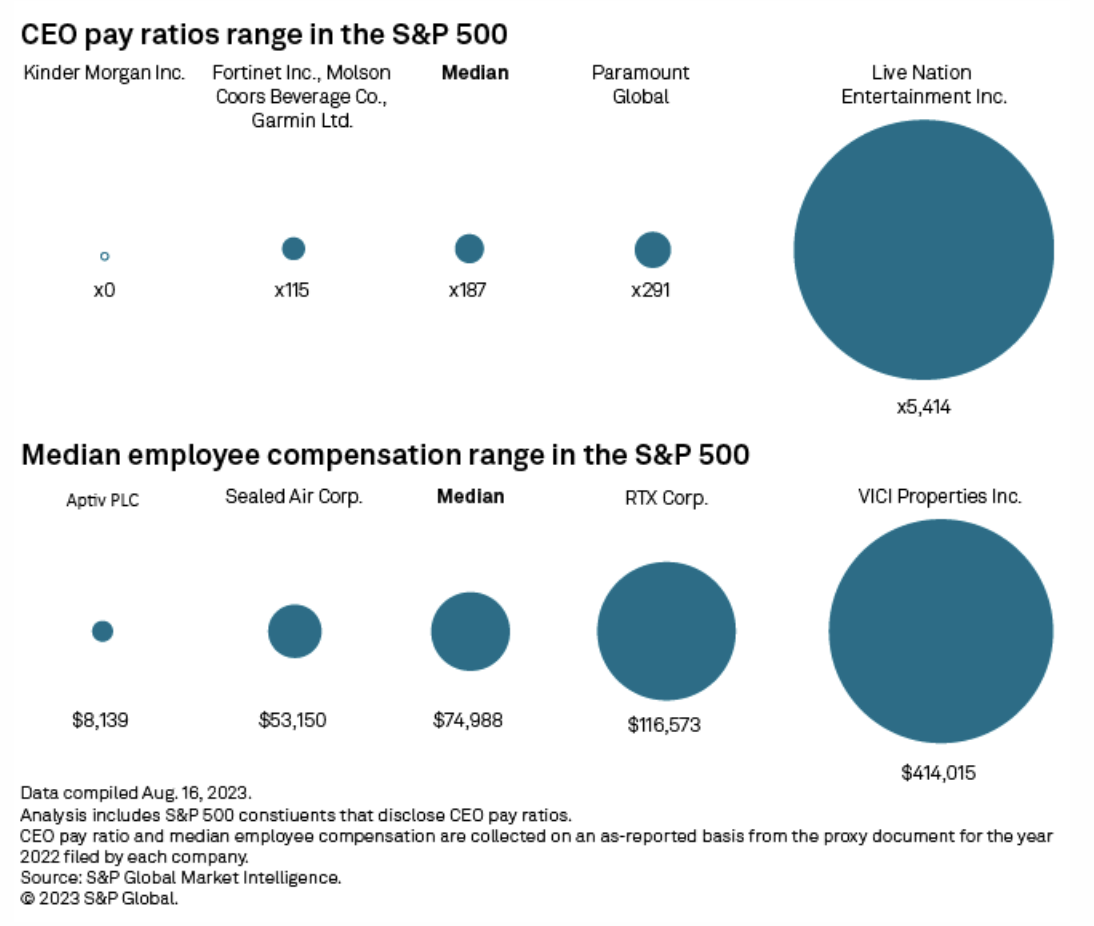

Live Nation Reports Largest 2022 CEO-To-Median Employee Pay Ratio Among S&P 500

Live Nation Entertainment Inc. reported the highest CEO-to-median employee pay ratio and among S&P 500 companies that disclosed such information for 2022, according to an analysis of the most recent data by S&P Global Market Intelligence. The CEO-to-median employee pay ratio at Live Nation stood at 5,414-to-1 in 2022, with the median employee's annual compensation at $25,673. However, Live Nation noted its proxy statement that the large ratio was the result of one-time extra compensation related to the renewal of CEO Michael Rapino's 5-year employment contract.

—Read the article from S&P Global Market Intelligence