Start every business day with our analyses of the most pressing developments affecting markets today, alongside a curated selection of our latest and most important insights on the global economy.

M&A Increases Among US Banks

During first half, M&A activity in the US banking sector fell abruptly. The high-profile failures of a few prominent regional banks, combined with higher interest rates and sudden changes to bank valuations, created uncertainty that had a chilling effect on dealmaking. But the third quarter has witnessed a revival in activity as banks and shareholders adjust to the new interest rate environment and the immediate fears of a banking crisis fade.

Announced deal values in the US banking sector declined to a relatively paltry $610 million in the first half. However, M&A activity has bounced back strongly in the third quarter to $1.65 billion — more than triple the announced deal value in the first quarter and about nine times greater than the announced deal value in the second quarter.

Much of the slowdown in the first half can be attributed to higher interest rates. As rates climbed, the market struggled to arrive at valuations. Sellers were loath to abandon higher valuations and anticipated a return to previous highs. Buyers struggled to model the effect of interest rate increases in the new environment.

"Most people are accepting the reality that something that was worth whatever it was worth 18 months ago is now worth a different, lower amount than it was," James Stevens, a partner at law firm Troutman Pepper Hamilton Sanders, said in an interview with S&P Global Market Intelligence.

S&P Global Ratings identified that tough operating conditions have placed a strain on certain US regional banks. Funding, liquidity, and spread income resulting from higher interest rates and quantitative tightening have raised the odds of asset quality deterioration for some US regional banks. About 90% of the US banks rated by S&P Global Ratings have stable outlooks and none have positive outlooks due to the challenging operating environment.

Despite these conditions, deal advisers anticipate that M&A activity will soon return to normal levels, particularly in 2024, due to pent-up demand. Josh Siegel, chairman and CEO of StoneCastle Partners suggested in a recent interview with S&P Global Market Intelligence’s “Street Talk” podcast that there are deals to be found in the US banking sector for investors. While some banks suffered deposit flight following the failure of lenders including Silicon Valley Bank, others enjoyed a flood of deposits that put them in an enviable position for further acquisition.

“It’s not a level field. … I would say the preponderance are more challenged than they were. But there are definitely banks out there that are flooded. And it tends to obviously be larger banks, but not completely. There still are smaller banks that are flush,” Siegel said.

Today is Monday, August 28, 2023, and here is today’s essential intelligence.

Written by Nathan Hunt.

Economy

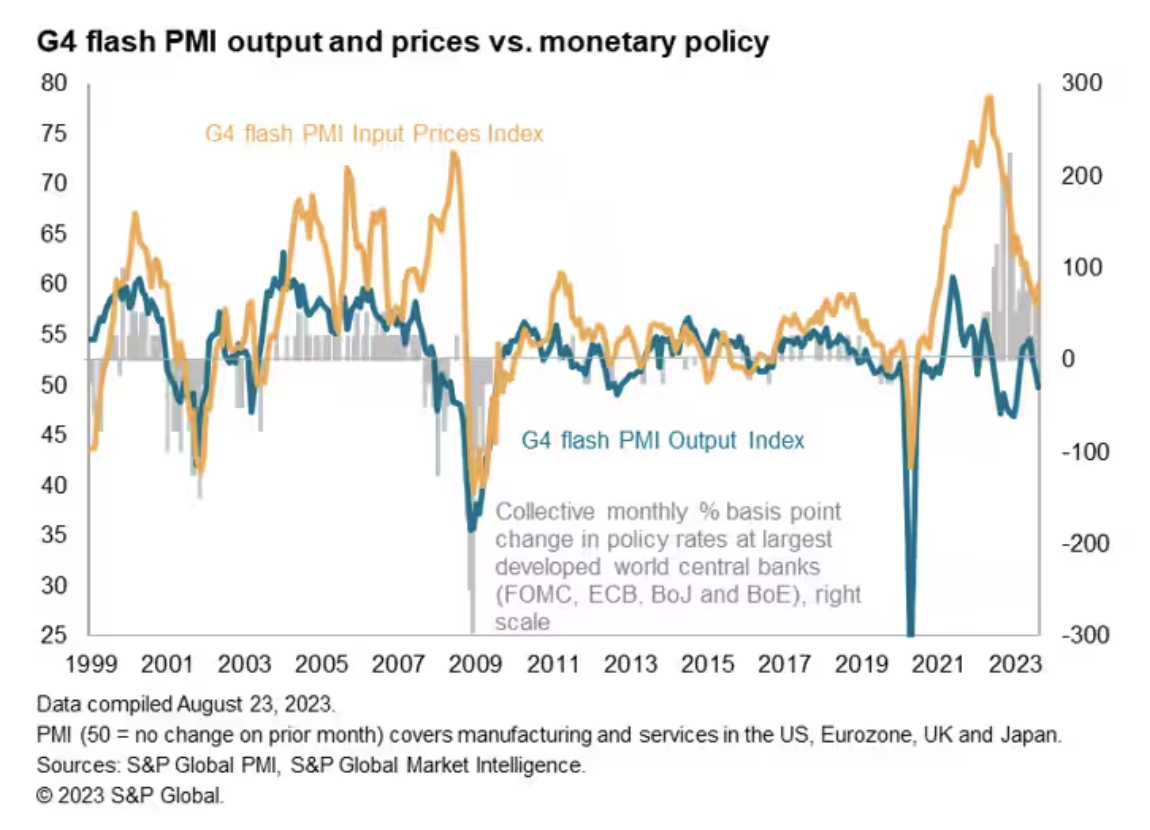

Flash PMI Signal Developed World Contraction As Higher Interest Rates Exert A Growing Toll

Early PMI survey data for August from S&P Global showed the major developed economies collectively slipping into contraction for the first time since January. Falling business activity in the Eurozone and UK, and a near-stalling of growth in the US, contrasted with robust growth in Japan and underscored how tighter monetary policy in the west is dampening demand.

—Read the article from S&P Global Market Intelligence

Access more insights on the global economy >

Capital Markets

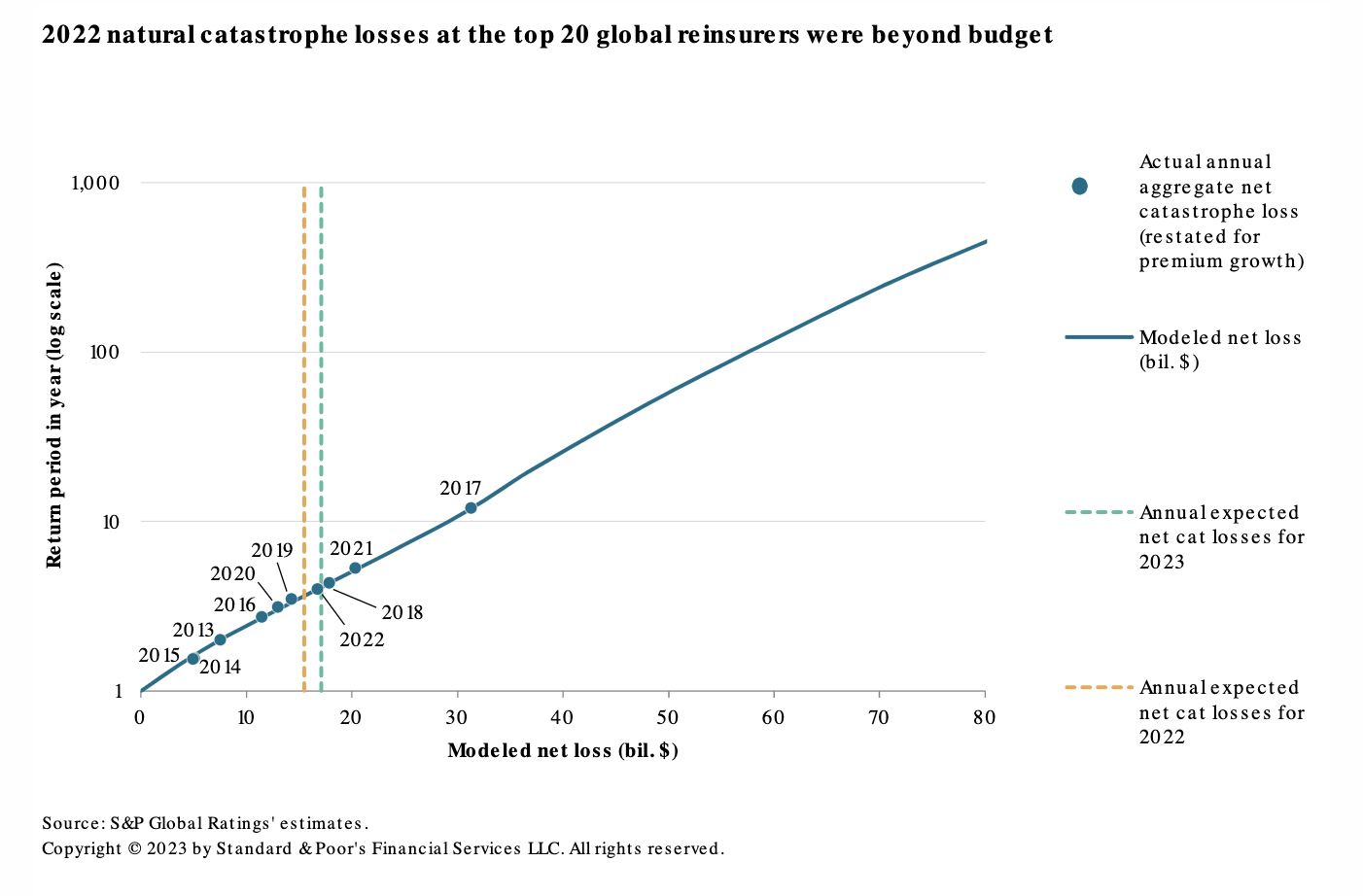

Catastrophe Risk Appetite Varies Among Global Reinsurers

In 2022, the global reinsurers saw another record year of natural catastrophe losses. The estimated insured losses of $125 billion were well above the long-term average expectation for the insurance industry. As a result, catastrophe budget expectations were exceeded for another year for the top 20 global reinsurers. Despite the growing cost of natural catastrophes, and the apparent divide in strategy observed in recent years, 2023 and 2024 could be a turning point for visible earnings improvements in the space. More reinsurers may aim to grow their catastrophe exposures as pricing continues to improve and demand remains strong. Still, many reinsurers entered 2023 with a cautious stance on property catastrophe risk.

—Read the report from S&P Global Ratings

Access more insights on capital markets >

Global Trade

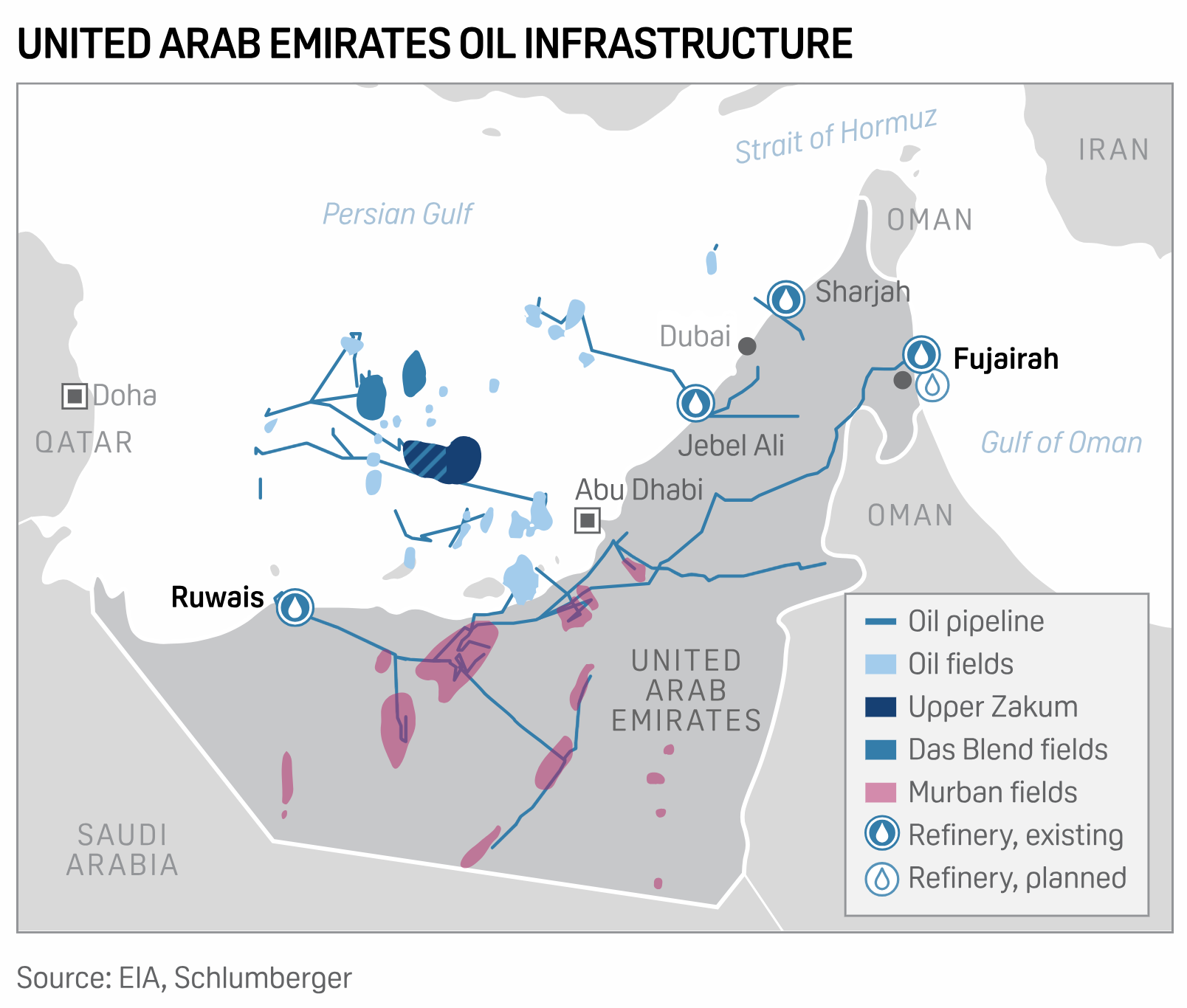

Fujairah Terminals Looks To New Railroad, Asia Trade For Expansion

AD Ports Group's Fujairah Terminals, which has operated at the Port of Fujairah under a 35-year concession since 2017, is looking at its connection to the UAE's Etihad Rail network and increased ties with Asia to enhance cargo traffic while the cruise business takes in more passengers, the company's CEO Abdulaziz al Balooshi said in an interview.

—Read the article from S&P Global Commodity Insights

Access more insights on global trade >

Sustainability

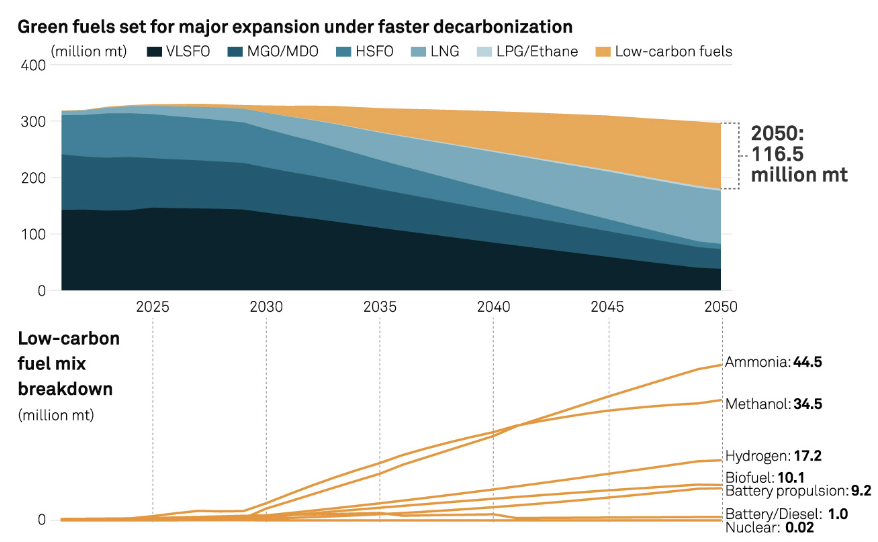

Regulators Push For Low-Carbon Bunker Transition For Net-Zero 2050

Maritime trades have been powered by residual fuels that emit high levels of air pollutants and greenhouse gases for decades, but a growing number of regulators are pushing vessel operators to use greener energy sources. Having lowered the global sulfur cap for bunker fuels earlier this decade, the International Maritime Organization has set decarbonization targets for cross-border shipping in the coming decades on the way to net-zero emissions close to 2050 and plans to introduce GHG rules for marine fuels in phases.

—Read the article from S&P Global Commodity Insights

Access more insights on sustainability >

Energy & Commodities

Listen: Is The Outlook Dimming?

Antoinette Smith, senior editor at S&P Global Commodity Insights, and Rob Westervelt, Chemical Week editor-in-chief, join Chemical Week senior editor Vincent Valk to discuss second quarter earnings. Topics include regional differences in the outlook, destocking and supply/demand and what could be in store for the rest of the year.

—Listen and subscribe to Chemical Week, a podcast from S&P Global Commodity Insights

Access more insights on energy and commodities >

Technology & Media

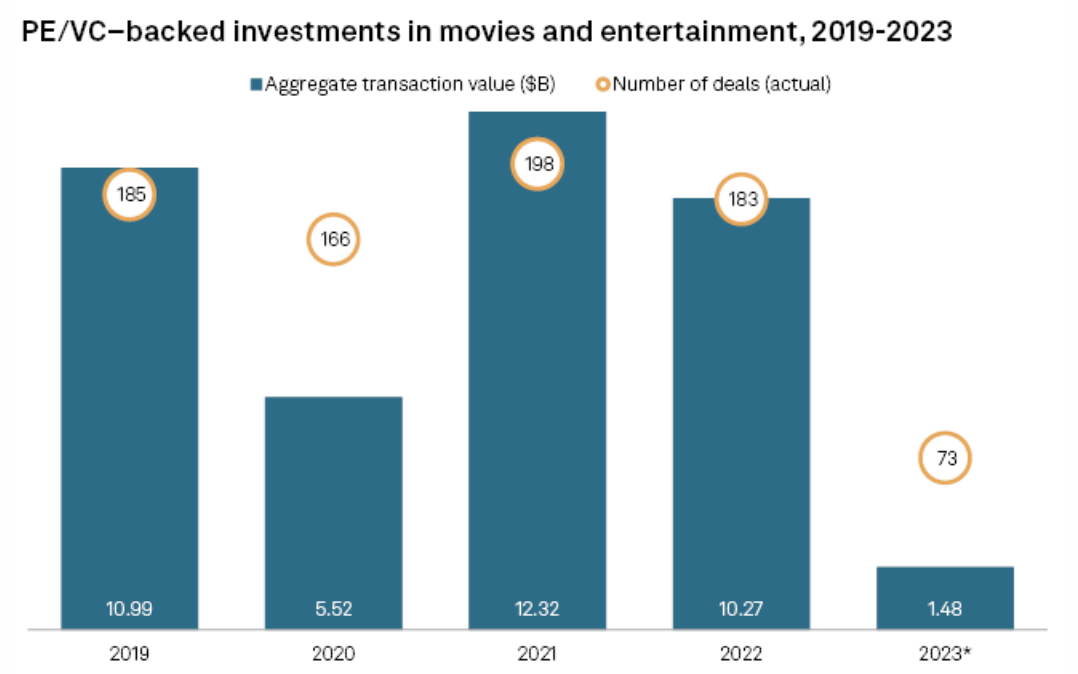

Private Equity Investment In Movies, Entertainment On Track For 5-Year Low

The value of global private equity deals in movies and entertainment companies is on its way to hitting its lowest annual level since at least 2019. Through Aug. 8, private equity and venture capital firms have announced $1.48 billion of investments in the movies and entertainment sector worldwide this year, according to S&P Global Market Intelligence data. That is well off the pace to match the $10.27 billion total invested in 2022.

—Read the article from S&P Global Market Intelligence